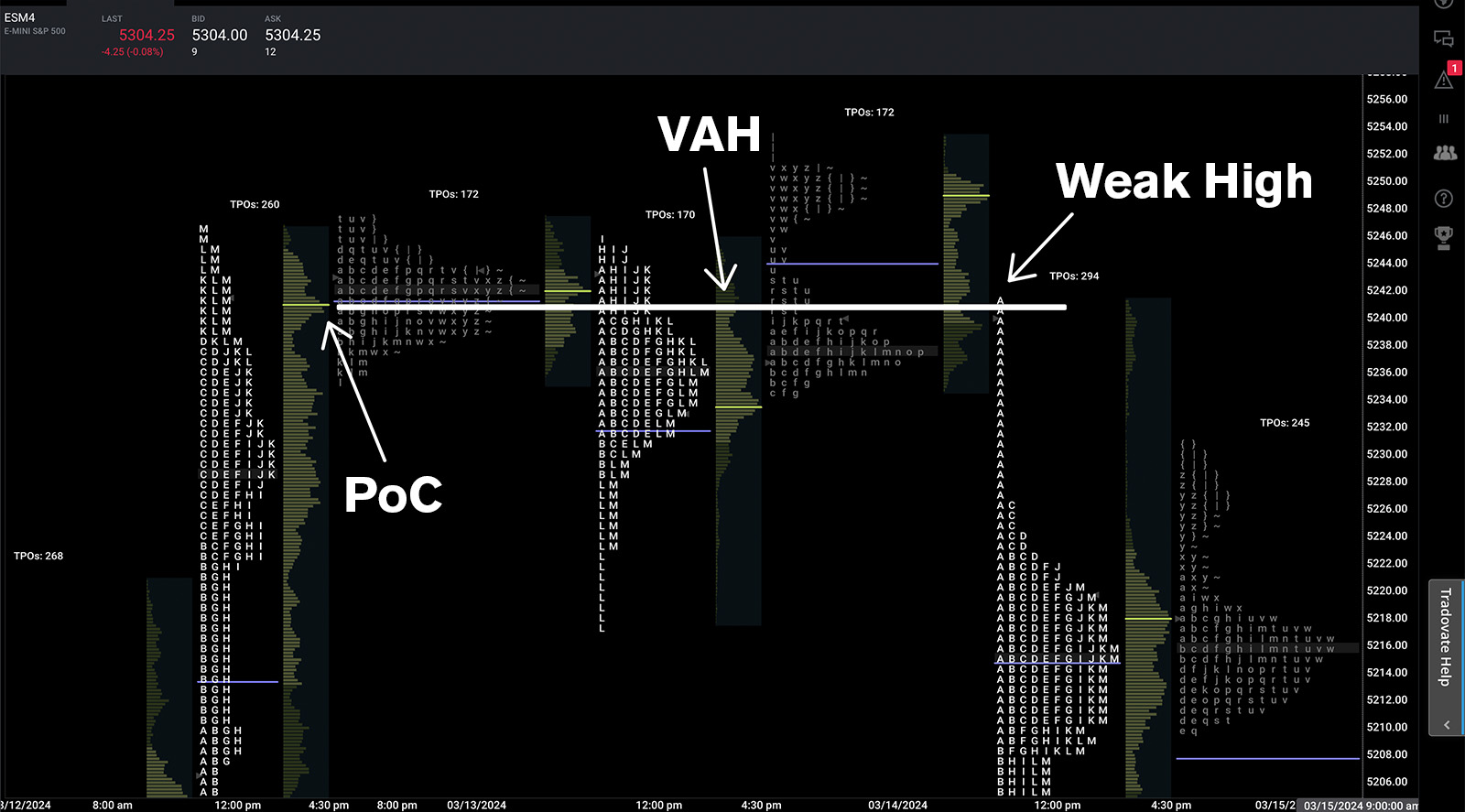

Market Profile: Weak & Mechanical Levels

A great way to visualize price action through the lens of an auction is the market profile. The profile tracks where prices are over time but when compressed, shows us at what price, the market spent the most time.

Within the market profile, there are specific structures that develop in reference to price and volume. Weak levels are where there are high degrees of precision. Because they are so exact we can also consider them mechanical levels. A weak high or weak low act as signposts for traders, hinting at what types of participants are getting active in the market.

A weak high or low forms when price makes a reversal at a very nuanced level, previously set in the market. Great examples would be the previous day’s high or low, previous day’s value area high or low, or any point of control. Prominent TPO’s are also fair game, but can be difficult to keep track of.

These levels are of interest because a precise touch and reversal tells us that there are short term traders who are dominating the price action.

Think about how stronger traders act. Is a hedge fund running a buy algorithm off of VWAP going to stop at an overhead point of control? Likely not. They have an order to fill and are probably not even paying attention to the prior point of control; or for that matter and of the more nuanced reference points that can confirm a weak level.

When a weak level is revealed due to this precise reversal, the assumption is that short term momentum traders are in control. We can choose to participate with them if we have more technical evidence that they are trading in the direction of the trend. Or we can look to exploit them on the next test of the weak level, knowing that the odds of a stop run may increase if broken.

A weak high can also be a poor high, and they are two separate classifications for the same level. The take away from each still both applies.

For more nuances on the market profile, read more from the godfather himself Jim Dalton. This book is dense, but a great thorough investigation of decades studying the auctioning of markets.