Volume vs. Open Interest

Volume and open interest are metrics that help traders understand the liquidity and activity within options and futures markets. “Volume” indicates the number of contracts traded over a specific period, while “open interest” represents the total number of active contracts that have not yet been settled. In this article we’ll specifically be referring to options and futures open interest and volume. Remember this is just one component of trading, and a full technical analysis should be considered before making decisions.

What is Volume?

Volume refers to the total number of contracts traded during a given period. Each trade, whether it’s a buy or a sell, counts toward the volume. For example, if 500 contracts are bought and sold in a day, the volume for that day is 500. Remember that for every buyer there is a seller and vice versa. One transaction does not count twice; once for the buyer, once for the seller. It is just one transaction, therefore volume will increase by one.

Volume resets to 0 at 4:00pm EST for options and 4:15pm EST for futures. Options volume starts to accumulate as soon as the 9:30am EST market opens. Options volume is counted per strike and expiration. Futures volume resets daily after the maintenance closure period at the open of the globex session at 6pm EST. There is no midnight reset for futures volume.

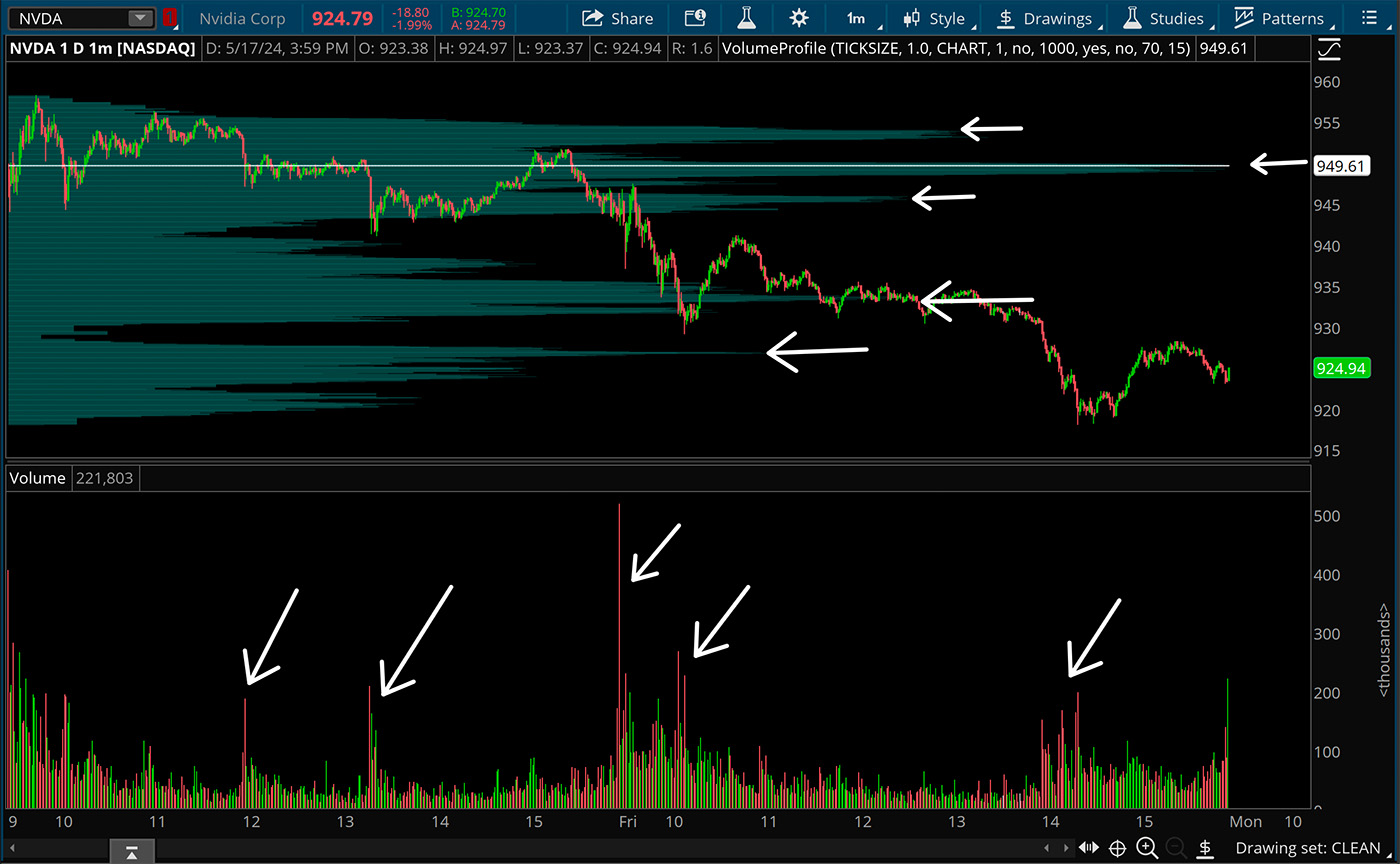

If you are looking at a chart, volume can be shown horizontally by period or vertically by price. Traders stand to learn more about the participants in the market when looking at volume by price. This is also known as volume profile.

Why Volume Matters

High volume means that the contract in question is highly liquid. There are many buyers and sellers in the market, making it easier to enter and exit positions without suffering from slippage.

Additionally high volume can confirm trends. For instance, if a price increase is accompanied by high volume, it suggests strong buying interest and a more sustainable trend.

What is Open Interest?

Open interest represents the total number of outstanding contracts that have not been settled or closed. It is the number of active contracts held by market participants at the end of the trading day. Unlike volume, open interest is not reset daily but accumulates as long as new contracts are being created and remain open.

Just like volume there is a buyer and seller to open every contract. So what if a buy order is someone else’s close order? Shouldn’t open interest always be nullified? No. Let’s use an example to understand further. Pretend this is an isolated situation for simplicity with no other participants.

You buy to open 5 contracts, and do not sell before the end of day. The open interest is 5. The next day you sell to close 2 contracts but open 10 more and hold them into the end of day. The open interest is now 13. The next day you add 10 more in the morning, but at the close sell 20. The open interest now falls to 3.

Why Open Interest Matters

High open interest indicates that many participants have open positions in the market, suggesting strong interest and engagement in that particular contract. If they just wanted to make a quick buck on a potential move open interest would not remain elevated and actually decrease as the move comes closer towards the end.

Comparing Open Interest and Volume

While both open interest and volume are important, they tell different stories about the market. More often than not, they should be used in conjunction with one another to paint a more full picture of what is happening.

- Rising prices in an uptrend with increasing open interest can indicate bullish sentiment and new money entering the market through long positions. People are buying and holding.

- Decreasing open interest alongside rising prices during an uptrend may suggest money leaving the market, which is a bearish sign. People are closing positions and “losing interest.”

- Falling prices in a downtrend with rising open interest suggest new money entering the market on the short side, supporting a continuation of the downtrend and indicating bearish sentiment. People getting short and staying short.

- Falling prices in a downtrend with declining open interest could indicate short covering near the lows. It’s possible that the move lower is over if no new money shorts are staying short.

- If volume is high but open interest is not increasing, it likely suggests that day traders are in control of the market. There is a lack of confidence to hold things overnight.

In the example above, we can see that the 930 calls expiring on May 17th 2024 have an open interest of 9k contracts vs a total volume on the session of 99k contracts. Because this is the same day the options expired, we can understand that many of those transactions were to close the out of the money calls. Thus volume increased while open increase likely decreased.

Compare this to the 935 puts expiring on May 31st 2024. There is higher open interest than there is volume. This perhaps indicates that someone is making a bet with a higher degree of confidence NVDA will be lower by the time May 31st comes around. The tricky part about options is that we do not know if this is simply a hedge, or a directional bet. We know theres interest, but we do not know the intent.

Conclusion

The difference between open interest and volume is essential for traders in the futures and options markets. Volume provides insight into the day-to-day activity and liquidity, while open interest offers a broader view of market participation and potential future trends. By analyzing both metrics, you will gain a deeper understanding of what is happening in the market and make more informed trading decisions.