Trading the Death Cross: A Bearish Moving Average Strategy

Moving averages are commonly used by traders to identify trends over different timeframes. A popular strategy that you may encounter is the moving average crossover, which involves a shorter-term moving average crossing a longer-term moving average. The Death Cross is a specific moving average crossover that as its name implies has negative implications.

There are many studies that evaluate what the best moving average crossover combination is but the true Death Cross involves the 50 simple moving average and 200 simple moving average (SMA from here on).

What is the Death Cross?

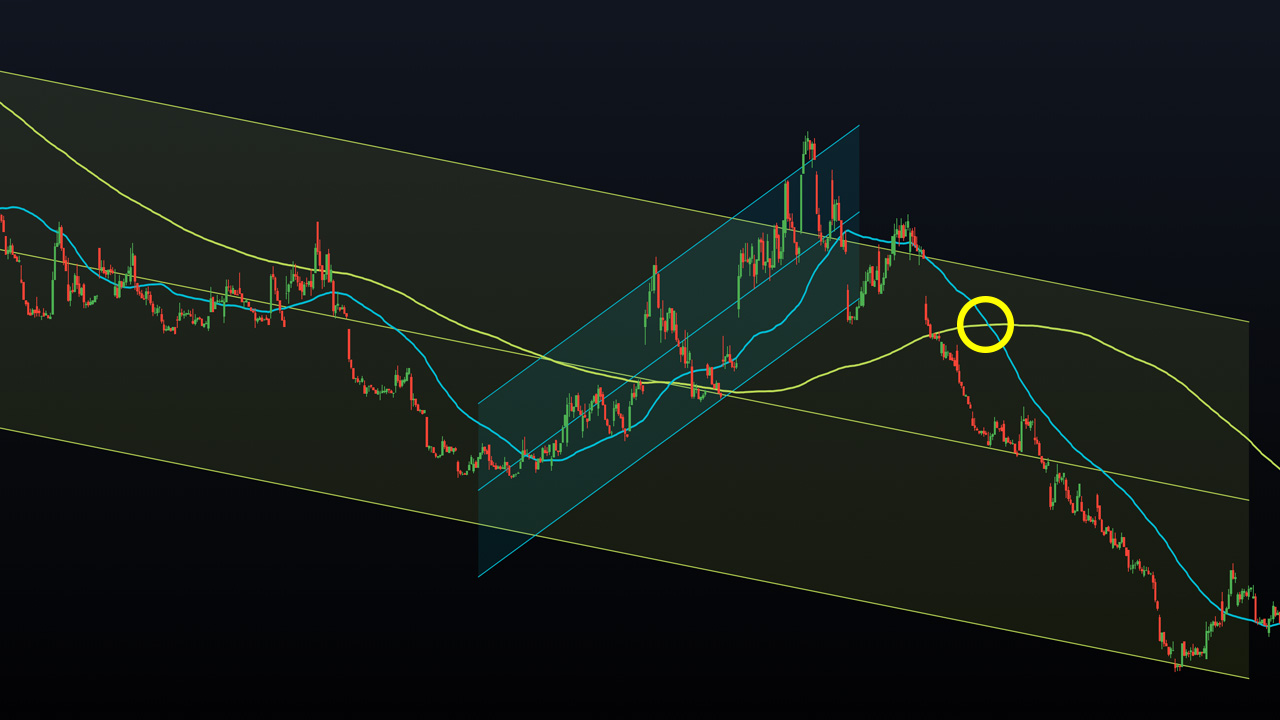

The Death Cross refers to the crossover of the shorter-term 50 SMA from above to below the longer-term 200 SMA. This crossover is viewed as a bearish signal and is considered a potential indicator of a reversal from a bullish or neutral trend to a stronger downtrend. When this Death Cross is accompanied by increased selling volume or other technical indications that suggest sellers are in control, it becomes even more powerful.

The Logic Behind the Death Cross

The Death Cross strategy is based on the belief that the crossover of two moving averages signifies a change in the short-term trend of an asset. When the 50 SMA crosses below the 200 SMA, it indicates that the short-term trend is gaining strength.

In the case of an existing long term downtrend, the Death Cross signifies the end of a short-term counter trend move. When we move back into alignment with the longer term downtrend, bearish outcomes should be expected. In the case of an existing long term uptrend, the Death Cross signifies that the long term uptrend is weakening and has the potential to reverse into a downtrend.

Using the Death Cross Strategy

The Death Cross strategy can be applied to various markets, including stocks, forex, and cryptocurrency. It can be adapted to different time frames to suit your trading style as well. When the 50 SMA crosses below the 200 SMA, traders should look for short entry points. It is important to note that the signal becomes more reliable when supported by other technical indicators that confirm a bearish bias. Higher timeframe signals are often more reliable than shorter timeframe signals too. For example a daily chart death cross is much more meaningful than a one minute chart death cross.

By entering a trade at the start of a new leg lower in the longer-term downtrend, traders can aim for an entry point close to the beginning of the trend, providing a favorable risk-to-reward ratio. Conversely, if the moving averages make the opposite move, with the 50 SMA crossing from below to above the 200 SMA, it is known as a Golden Cross and implies a bullish signal. However, the Golden Cross should not be used as a sole reason to exit Death Cross short entries.

There are two scenarios that can trigger an exit from a Death Cross trade: hitting the target or reaching the stop loss. If a Golden Cross occurs soon after a Death Cross, it should not be the sole reason to exit the trade. Traders should stick to their initial risk management plan and hold the position until the target or stop loss is reached.

False Signals

While the Death Cross strategy provides a clear visual signal for potential trend reversals, it is important to recognize its limitations. The strategy may generate false signals during choppy or sideways markets, and it should not be the sole reason for entering a trade. It is crucial to have a comprehensive trading strategy that incorporates other indicators and analysis to increase the probability of success.

It is worth noting that moving averages are lagging indicators, meaning they reflect past price data rather than predict future movements. They smooth out price fluctuations over a specified period and provide insights into historical trends.

Conclusion

The Death Cross strategy can be a valuable tool in your technical analysis toolkit, offering a clear visual signal for potential trend reversals and bearish market conditions. However, it should be used in conjunction with a comprehensive trading strategy, including risk management tactics, to generate a profitable edge over the long term. Always conduct thorough analysis and consider other technical influences before making trading decisions based on the Death Cross pattern alone.