What is the Russell 2000 Index

The Russell 2000 Index is a stock market index that tracks the performance of 2,000 small-cap companies in the United States. Created by the Frank Russell Company in 1984, it is a subset of the broader Russell 3000 Index, which includes 3,000 of the largest U.S. stocks. The Russell 2000 Index is often used as a benchmark for the performance of small-cap stocks.

What is a Small-Cap Company?

Before diving into the details of the Russell 2000, it’s important to understand what a small-cap company is. The term “small-cap” refers to a company with a relatively small market capitalization. Market capitalization is calculated by multiplying the current share price by the total number of outstanding shares. Small-cap companies typically have a market capitalization between $300 million and $2 billion. These companies are generally younger and smaller than their large-cap counterparts, which can mean higher growth potential but also higher risk.

Composition and Weighting

To understand the Russell 2000, you need to know the Russell 3000. The Russell 3000 represents approximately 96% of the total investable U.S. equity market. This includes small-caps all the way to mega-caps. The Russell 2000 Index shaves off 1,000 mid to mega-cap stocks from the Russell 3000 Index. What’s left is the Russell 2000, representing about 10% of the total market capitalization of the Russell 3000.

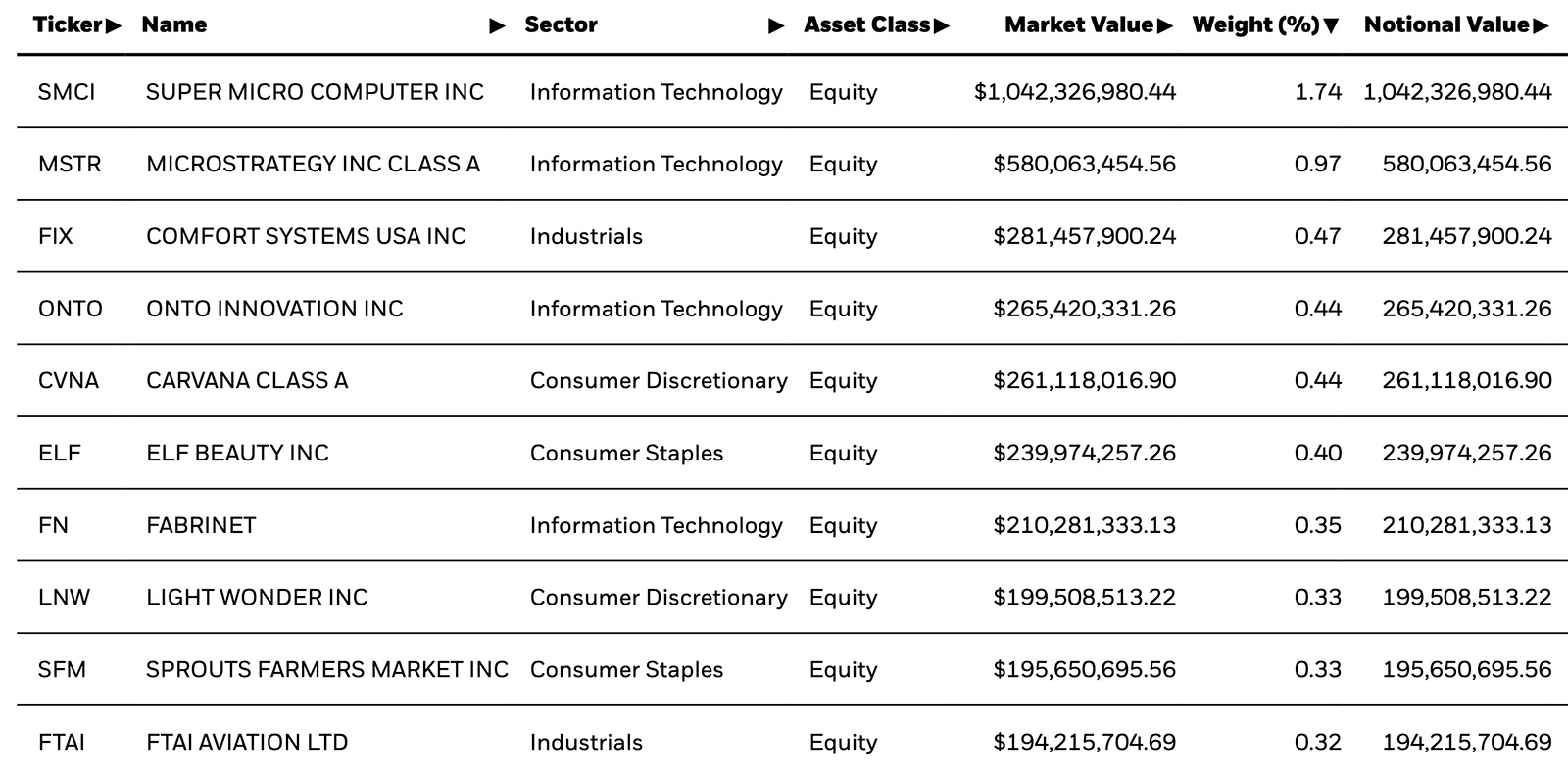

The index is weighted by market capitalization, meaning that companies with larger market caps have a greater impact on the index’s performance. The composition of the index is updated annually to ensure it accurately reflects the small-cap segment of the market. Here it is as of May 27, 2024.

Selection Criteria

The selection process for the Russell 2000 Index is straightforward. It involves ranking the 3,000 largest U.S. stocks by market capitalization and then selecting the 2,000 smallest companies from this list. This methodology ensures that the index remains focused on small-cap companies and provides a comprehensive picture of this market segment.

Performance and Volatility

Small-cap stocks, like those in the Russell 2000, tend to be more volatile than large-cap stocks. This means they can experience larger price swings, both up and down. Investors often look to the Russell 2000 for higher growth potential, as small-cap companies may have more room to grow compared to established large-cap companies. However, this growth potential comes with higher risk. The performance of the Russell 2000 can be influenced by various factors, including economic conditions, interest rates, and investor sentiment toward smaller companies.

Historically, the Russell 2000 will underperform other market benchmarks like the S&P 500 index and the Nasdaq 100 index. To get the benefit of small-cap growth or acceleration, you would need to be an accurate stock picker with the ability to pick the winners from the index, and avoid the losers.

Uses of the Russell 2000 Index

Many investors use the Russell 2000 as a benchmark to compare the performance of small-cap mutual funds, exchange-traded funds (ETFs), and other investments. It helps investors gauge how well their small-cap investments are performing relative to the broader market.

Analysts and economists use the Russell 2000 to assess the overall health of the market and economy as a whole. Since small-caps are often more sensitive to changes in the economy and financial policy, the index can provide early signals about economic trends.

At the Trade Brigade, we use the Russell 2000 as a breadth indication and evidence that the broad market is building a tailwind or a headwind. Intra day, if the Russell is divergent from the Nasdaq usually the S&P will be stuck in the middle of push and pull. If the Russell and Nasdaq are convergent, it will usually increase the odds of follow through in that direction for the S&P.

Russell 2000 ETFs and Funds

Several ETFs and mutual funds track the performance of the Russell 2000 Index. These funds are designed to replicate the index’s performance by holding a similar basket of stocks. Some of the most popular Russell 2000 ETFs include:

iShares Russell 2000 ETF (IWM): This is one of the largest and most well-known ETFs that track the Russell 2000 Index. It provides investors with broad exposure to the small-cap segment. Read more.

Vanguard Russell 2000 ETF (VTWO): Another popular ETF, VTWO offers a low-cost option for investors looking to track the Russell 2000. Read more.

SPDR Russell 2000 ETF (TWOK): This has been delisted for a while now and replaced with the S&P 600 Small Cap ETF SPSM. Read more about it here.

These ETFs offer investors an easy way to invest in the Russell 2000 Index and benefit from the potential growth of small-cap companies.

Conclusion

The Russell 2000 Index is a valuable tool for investors looking to gain exposure to the small-cap segment of the market. It provides a benchmark for assessing the performance of small-cap investments and offers insights into the health of the entire economy. Small caps often have higher volatility and risk, but if you pick the right individual companies you may be rewarded for taking that risk (easier said than done).

Perhaps the most important use for the Russell 2000 is the intraday support it offers to understanding the movements of the broad market. Ensuring that you are trading in the direction of broad market confluence between the big three will make your execution much easier than battling a constant headwind. This is one component of the well rounded analysis approach traders should take to trading.