What is a Trading Journal?

A trading journal is a record-keeping tool that traders use to track and analyze their trading. By documenting trades, traders can more easily assess performance, and most importantly harness the data to identify areas of improvement that can lead to improved profitability.

Keeping a trading journal involves documenting various details of each trade, such as the date, time, entry and exit points, position size, and the rationale behind the trade. To truly gain actionable insights, traders should take it one step further and log their intended targets, stop losses, intended risk:reward, realized risk:reward, profit missed, playbook used, and any mistakes made. This information is crucial for developing better trading strategies and habits.

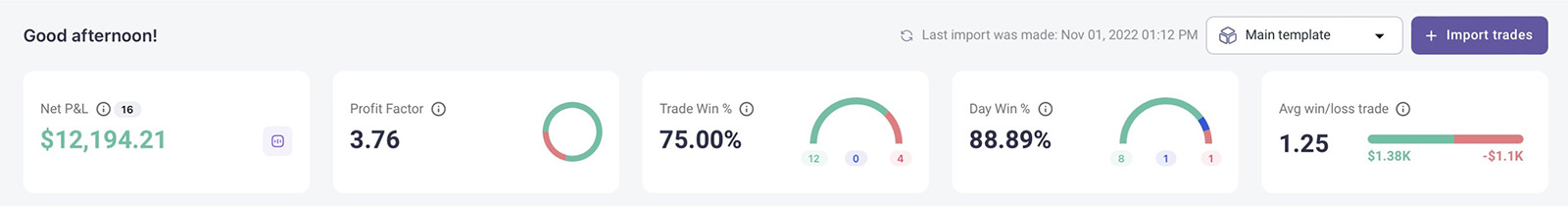

Looking for our recommendation? Look no further than TradeZella! Read more about it here.

Save 20% on TradeZella

TradeZella allows you to harness your trading data and gain actionable insights to becoming a profitable trader. Use code "TB" at checkout.

Why Use a Trading Journal?

Performance Tracking – Strengths vs Weaknesses

A trading journal allows traders to track their performance over time. By recording each trade, traders can see their successes and more importantly failures, helping them understand what strategies work best.

An ideal way to segment performance is by setup. For example, how do you perform when trading two day high breakouts on the first pullback? How do you perform when trading a possible gap fill reversal? The idea is that you know the expectancy of each setup and can size trades appropriately when you have a high expectancy setup emerge from the market.

Beyond tagging for setup, the journaling software that you use should also be able to tag for mistakes. Custom tags are great for this as each individual trader likely has different criteria for what classifies a mistake. If you have a trade that does not go according to plan, you should be able to identify what happened to avoid making that same mistake in the future.

Accountability

Maintaining a trading journal is a simple way to hold traders accountable. Traders are more likely to follow their trading plans and strategies when they know they will be documenting and reviewing their trades.

Do you really want to write to yourself that you oversized a trade? Then you got emotional because it was too large yet you didn’t close it out? Then instead of respecting your normal stop, you let it go further hoping it would rebound… because goodness… you can’t take that larger than normal loss! Then there was no rebound, and you find yourself holding onto a trade down -90% with a blown account. Do you really want to have to write that in your journal?

This habit of logging your trades, and thoughts while in the trade can reduce impulsive decisions that often lead to unnecessary outsized losses.

Strategy Testing

Trading journals should also be a place to test out new strategies without the fear of losing real capital. Whether it’s a true backtest with tradable historic data or just a place where you track the potential expectancy of a new strategy, think of a trading journal like a playground for strategy development.

Key Elements of a Trading Journal

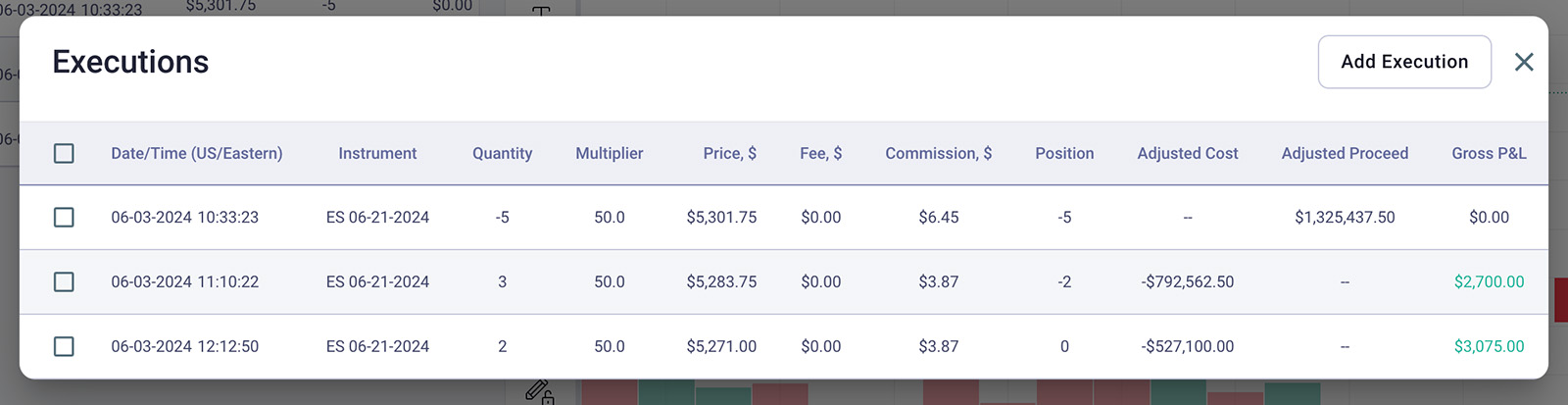

Trade Details

This includes the date and time of the trade, the asset traded, the position size, and the entry and exit points. This basic information is the foundation of any trading journal.

Strategy and Rationale

To add more context to the details, traders should document the reasons behind each trade, including the strategy used and the analysis that led to the decision. In this phase, the intended targets and stop-loss location are required to paint the full picture of the strategy.

Knowing the outcome of the trade is one thing, but what if you are consistently overly optimistic… or heck, even overly pessimistic. This context is crucial for evaluating the effectiveness of different strategies and identifying areas of potential improvement.

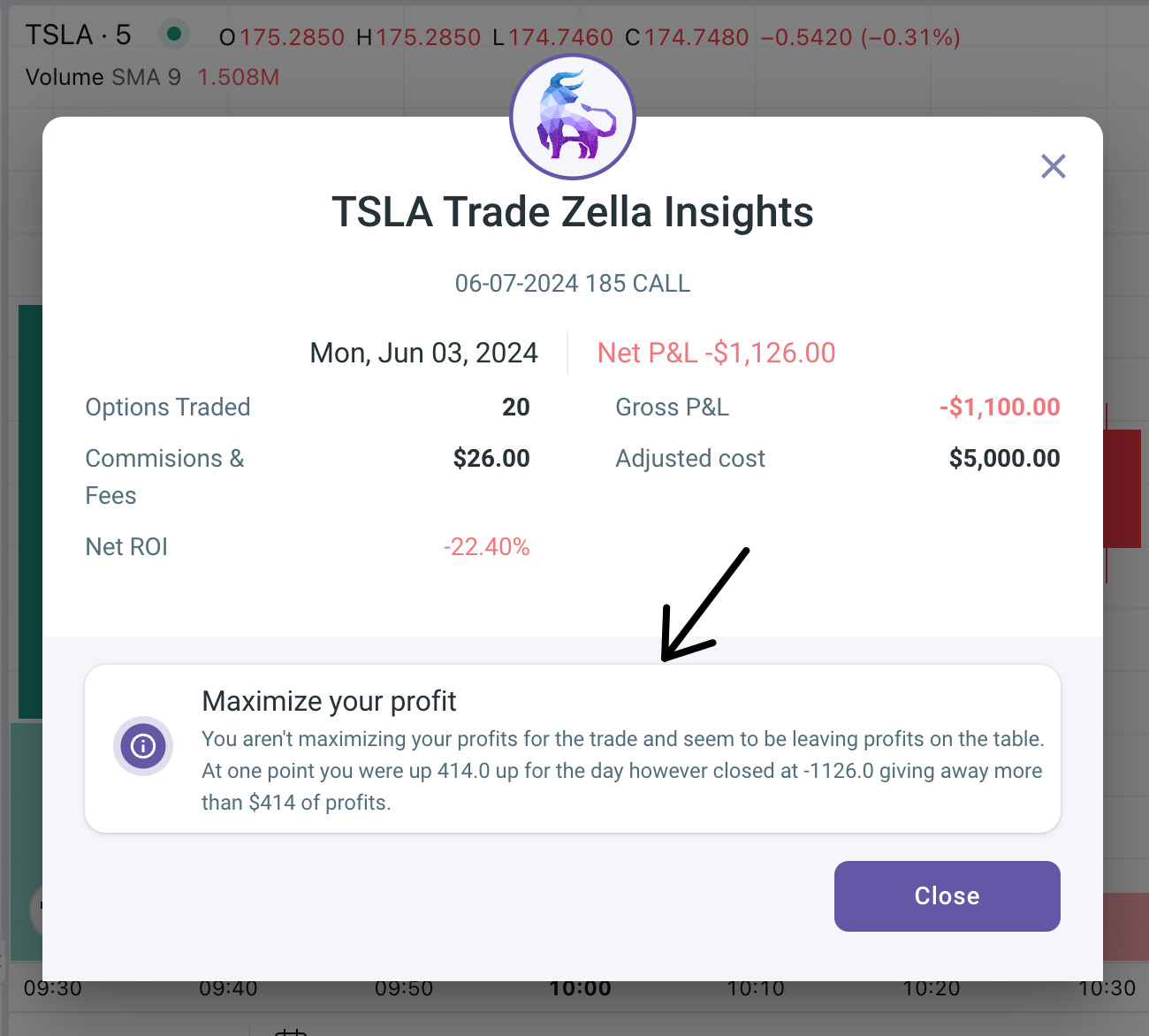

Outcome

Obvious metrics here are the total profit and loss, and win rate. However as mentioned above, in this segment, look beyond the obvious. How does the outcome compare to the intent? What can you learn about how effective you are at setting stop losses? Are they consistently too tight? Too loose?

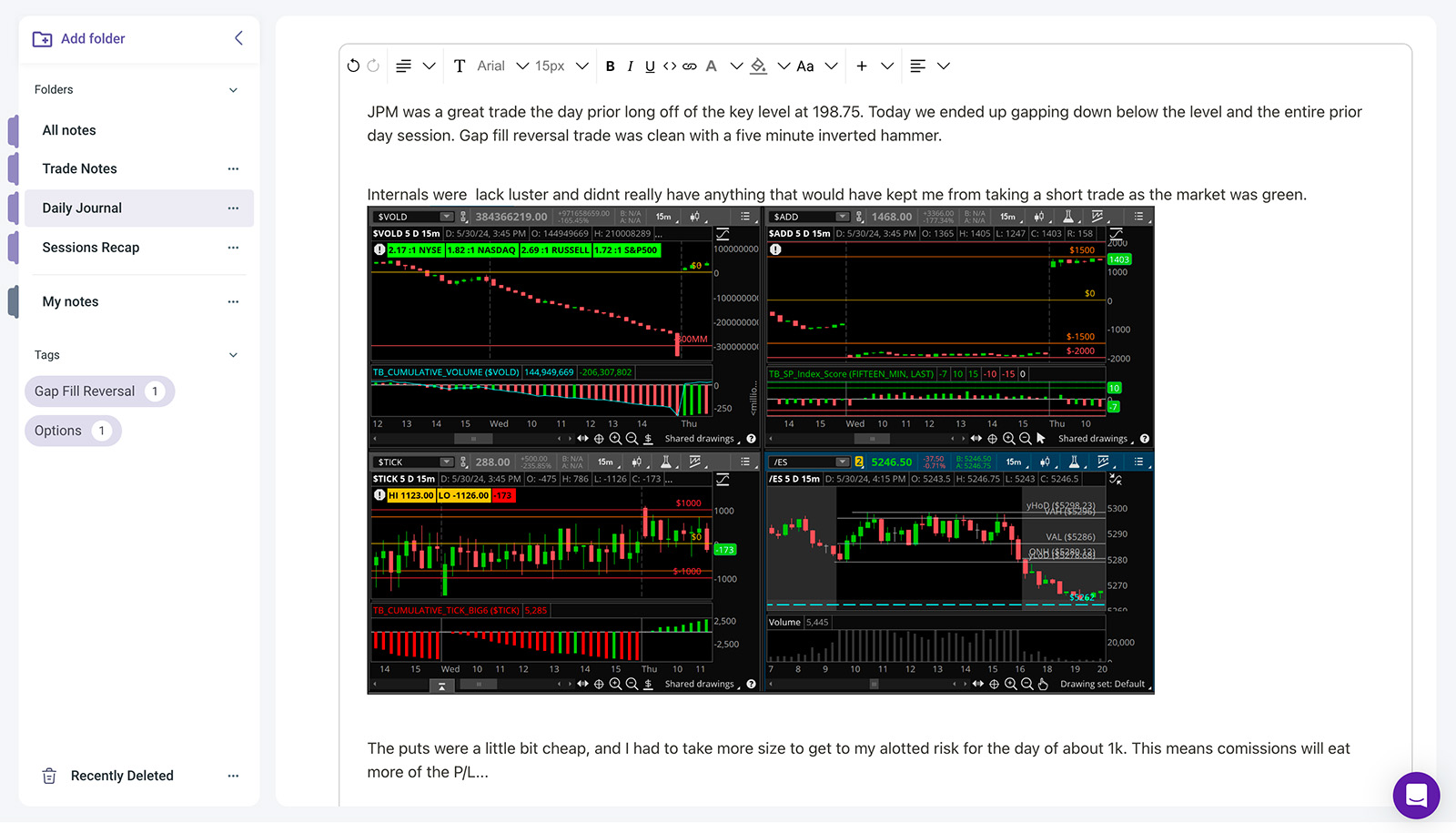

Emotions and Observations

A notebook section of the journal is required as well. This should be a comprehensive place to take notes about your emotional state in the trade, if there was any relevant news that impacted the trade, and the overall context of the market.

A good trading journal has the ability to add photos and screenshots to the notes section of a trade. One of the popular attachments the Trade Brigade team likes to include is the internals dashboard as a contextual overview.

Benefits of a Trading Journal

The biggest benefit of a trading journal is the ability to build confidence in your strategies. The idea is to build a huge amount of data that suggests your strategy has positive expectancy. It’s understandable to be hesitant on executing trades if you don’t have confidence in the system. However, if you have 500 trades in your journal that suggest you have an actual edge in the market, you should become robotic about actually taking setups. Unless there is a fundamental change in the market conditions that invalidate your strategy, trading should become “boring” and every setup is just another opportunity for your edge to play out.

Once you have a concrete edge in the market and you’re at this point in trading, it’s probably time to consider sizing up if you want to generate more income. That would be stage three in the trading roadmap.

For traders who are not yet profitable, journaling is even more important! This is because you’ll finally have an accurate picture of what is causing you to lose money. Is it your risk management approach? Is it your win rate? If you’ve accurately documented the trades you’re taking it should be easy to pinpoint what needs improvement.

If you are constantly stopping out for much larger losses than your average win, you’ve got to find a different setup that has larger targets and keep the stops the same. An alternative could be to find a different way to manage the stop losses on these trades? Why is the stop so loose in the first place?

These are the questions you can dive into if you have the data logged in your trade journal.

Conclusion

A trading journal is a must have tool for any serious trader. Profitable or on the journey to profitability it provides a structured way to track and analyze trades. You’ll be able to harness your data to gain insights that can lead to better performance and overall a higher likelihood of profitability. By documenting trade details, strategies, outcomes, and emotions, you can develop better strategies, manage risk more effectively, and gain greater control over your trading decisions.