Understanding Futures Contract Rolls: A Guide for /ES and /NQ Traders

Futures contracts have expiration dates that are similar to options contracts. At some date in the future, the buyers and sellers of the contract ultimately agree to some exchange. As we approach that expiration date, the futures market usually rolls the contract over from the current front month, to the current back month contract. When the roll is complete, the previous back month contract will now be considered the current front month contract.

Don’t let the jargon confuse you. A front month contract is the contract that is nearest to expiration. In the case of financial index futures, there are quarterly rolls. The current quarterly contract would be the front month. The back month contract is the contract that expires in the next series. In the case of the financial futures example, it would be the next quarterly expiration.

Some platforms automatically account for this futures roll by providing something called the continuous contract for charting and analysis. Usually you can find this by not adding the expiration extension at the end of the symbol on your chart provider. For example in the E-Mini S&P futures you would look for /ES instead of /ESZ23 (December expiration of 2023). When trading the continuous contract, make sure that your platform has the capacity to “adjust for contract changes” or “back adjust” for your levels to remain relevant.

Why Do Traders Roll?

Traders roll their contracts near expiration to avoid settlement of the underlying asset. The way futures were originally intended to trade involves physical commodities and the settlement would be the date when the exchange takes place between dollars and goods. With the advent of cash settled futures, it would be the date in which the dollar transaction takes place.

Most people trading the futures market are doing exactly that, trading and not investing in the futures. Futures instruments have always been an instrument primarily used for hedging strategies not investment strategies. Instead of looking for the settlement to make profit, people interested in maintaining the hedge will roll through the contract expiration to avoid needing to settle with cash.

The roll requires closing out the existing position in the current front month, and re-establishing the position in the current back month which will turn into the front month after expiration. The roll usually starts the Friday of the week before expiration and lasts the full week of expiration. Most traders opt to wait to switch over to the new contract when the volume exceeds that of the current front month.

Price Differences At Expiration

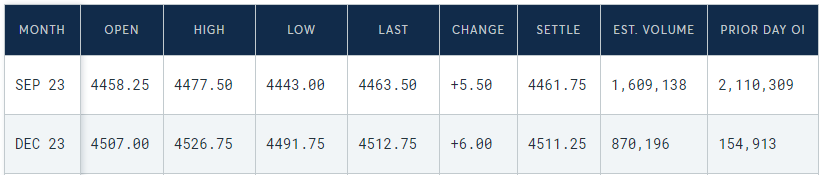

When contracts roll over, there is bound to be a price difference between the two contracts. This can largely be attributed to the fact that the back month contract is pricing in more time and volatility, and thus will be more expensive. Those already in the back month, have paid the price of the elevated volatility premium, and likely will not let the contracts trade at the lower price of the near expiry front month.

There is no exact formula that defines what the spread between front and back month price will be, however liquidity should always be the driving factor for those looking to roll. As a trader your primary concern should be getting involved in the contract that has the most liquidity and thus highest probability of trading efficiently.

Tools and Resources

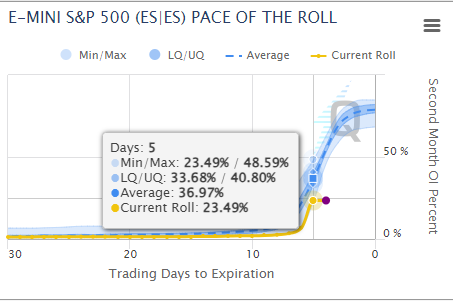

The CME group has the best tools available to learn more about the pace of the roll. They have tools that track the speed at which traders typically switch contracts to illustrate a fast vs slow roll.

They also have clear ways to observe the open interest and volume that are trading between the two contracts.

Conclusion

The financial index futures roll quarterly on the day known as the quad witching. Thus, four times a year we have to be concerned with the volume and liquidity around the front month vs back month contract. It’s possible that markets may experience heightened volatility around these times of year, and some traders choose to avoid trading this period altogether.

At the end of the day, as day traders of futures, all we have to be worried about is heightened volatility, and switching contracts as soon as there is more volume being transacted in the back month contract vs the front month contract ahead of the roll.