Understanding Carry Trades

Carry trades allow traders to take advantage of interest rate differentials between countries. This trading strategy is often used in foreign exchange (forex) trading, where currencies from different economies with varying interest rates are traded against each other. The goal is simple: borrow money in a country with low interest rates and invest it in a country with higher rates, profiting from the difference.

What is a Carry Trade?

A carry trade involves borrowing in a currency with a low interest rate and using that capital to invest in an asset with a higher return. This difference, known as the “carry,” is where the profit is made. The most common scenario for this strategy occurs in the forex market, where there are large differentials between countries’ interest rates.

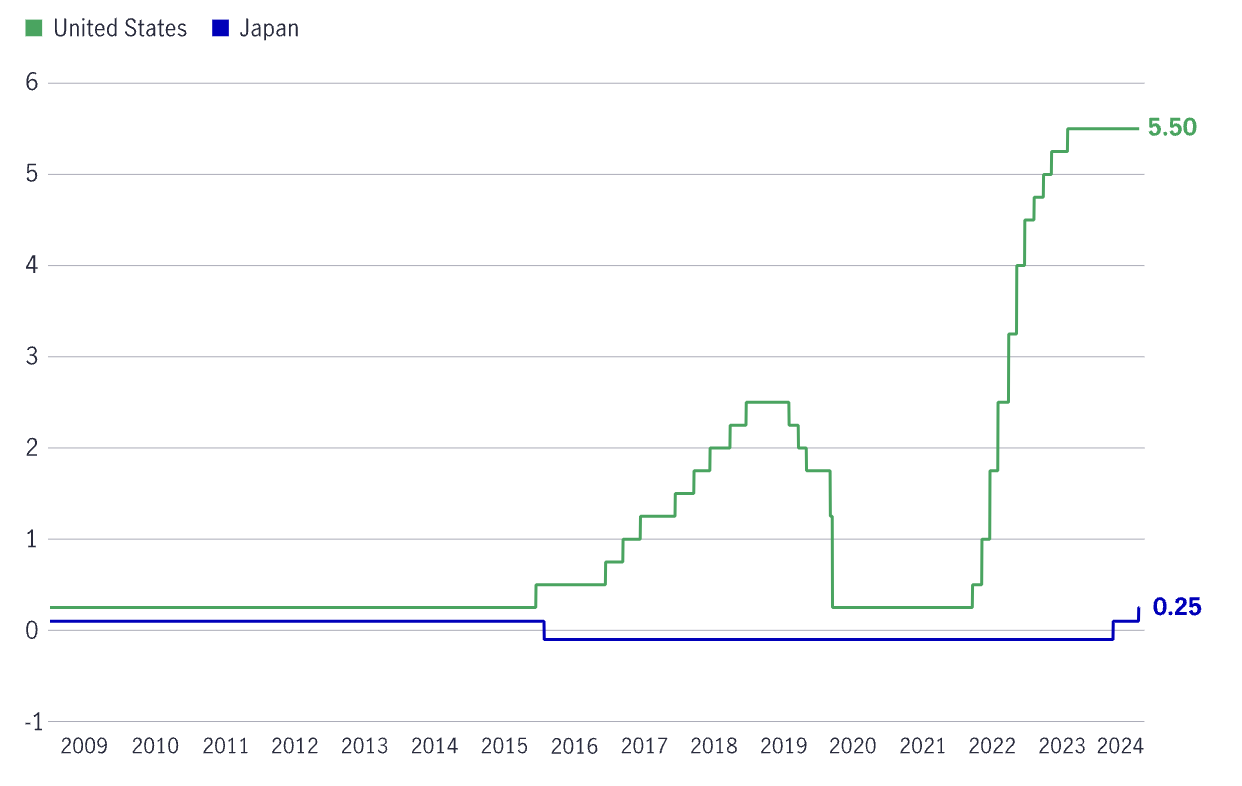

For example, if a country like Japan has very low interest rates (which they historically do, due to yield curve control), traders may borrow Yen and then convert it into another currency, such as the U.S. dollar, to invest in American assets that yield a higher return. The difference between what the trader earns on the U.S. assets and what they pay to borrow Yen is the profit collected. Remember this is not free money, and borrowing costs need to be considered. We’ll see how that poses a risk in just a moment.

The Mechanics of a Carry Trade

Carry trades are relatively straightforward in principle, but they depend heavily on two factors: interest rate differentials and currency stability. Here’s how it typically works:

- Borrowing the Low-Yielding Currency: The trader borrows in a currency where the cost of borrowing (interest rate) is low. In the case of the Yen carry trade, Japan has had near-zero interest rates for years, making it an attractive borrowing currency.

- Converting to a Higher-Yielding Currency: The borrowed amount is then converted into a higher-yielding currency, like the U.S. dollar or Australian dollar, where interest rates are higher. The funds are invested in assets or bonds that generate a return.

- Profit from Interest Rate Differentials: The trader profits from the difference in interest rates. For example, if the interest rate in Japan is 0.1% and in the U.S. it is 5%, the trader earns the 5% on U.S. assets while paying only 0.1% on the Yen borrowed. A gross differential of 4.9%.

The Risks of Carry Trades

Carry trades can be highly profitable but come with significant risks. While the main draw of the strategy is earning the interest rate differential, unexpected market moves can wipe out those profits. Here are the main risks to consider:

- Currency Fluctuations: Exchange rates can move unpredictably, causing the value of the borrowed currency to rise. If the Yen strengthens significantly against the dollar, for example, the trader would face a loss when they need to convert their profits back into Yen to repay the loan.

- Interest Rate Changes: Central banks can change interest rates unexpectedly. If Japan were to raise rates, the cost of borrowing Yen would increase, potentially cutting into profits or even turning the trade unprofitable.

- Market Liquidity: In times of market stress, liquidity can dry up, making it difficult for traders to exit positions without significant losses. This is particularly relevant for carry trades involving emerging markets or less liquid assets.

The Yen Carry Trade and the August 5th Issue

One of the most well-known carry trades involves the Japanese Yen, given Japan’s historically low interest rates. Recently, the Yen carry trade faced heightened scrutiny following developments on August 5th, when the Bank of Japan hinted at possible policy changes.

For years, traders have been borrowing Yen to invest in higher-yielding currencies, particularly the U.S. dollar. This trade has been highly profitable as the U.S. Federal Reserve raised rates aggressively while Japan kept its rates near zero. However, on August 5th, the Bank of Japan signaled that it might allow interest rates to rise in the future, leading to concerns that the Yen could strengthen.

A stronger Yen would make it more expensive for traders to repay the Yen they borrowed, potentially leading to significant losses on carry trades. This event caused a ripple effect across markets, as traders reassessed their positions in light of the potential for Yen appreciation.

How Carry Trades Affect the Broader Market

Carry trades can have a large impact on global financial markets. When these trades are widely adopted, they can contribute to capital flows that influence asset prices and exchange rates. For example, large-scale carry trades into higher-yielding currencies like the U.S. dollar can drive up the value of those currencies while depressing the value of the funding currency, such as the Yen.

However, when the tide turns and traders unwind their carry trades, this can lead to sudden and dramatic shifts in currency values. If traders start exiting their Yen carry trades en masse, the Yen could strengthen rapidly, causing turmoil in currency markets and potentially triggering broader financial instability.

Hedging Against Carry Trade Risks

Given the risks involved, many carry traders use hedging strategies to protect themselves against adverse movements in exchange rates. One common approach is to use options or futures contracts to lock in exchange rates, mitigating the risk of large currency moves.

Another method is diversification. By spreading carry trades across multiple currencies and asset classes, traders can reduce their exposure to a single currency or market. For example, instead of borrowing exclusively in Yen, a trader might also borrow in Swiss francs or euros, depending on the interest rate differentials in those currencies.

Conclusion

Carry trades take advantage of interest rate differences between countries, and work best when markets are stable and rates relationships remain profitable. On the flip side, they also carry substantial risks, especially from currency fluctuations and interest rate shifts, which can eat up profits quickly or even turn a winning trade into a loser.

The recent Yen carry trade developments on August 5th highlight how quickly market conditions can change. Just overnight the market had gone from signaling “everything is fine” to “everything is broken.” If you are going to experiment with carry trade ideas, be sure to understand how to hedge them properly to avoid total account blow up.