Trading Physical Gold vs Gold Mining Companies

Gold has long been considered a defensive safe-haven asset, but how you choose to play the yellow metal can make a big difference. There are two main ways to get exposure to gold: buying the metal itself, or buying shares in gold mining companies. While both are connected to the price of gold, they don’t always move in the same direction or at the same pace.

Trading Gold Directly

When you trade the metal outright, price and its impact on your position is very simple to understand. When the price of gold goes up, the value of your holding goes up. When the price of gold goes down, the value of your holdings goes down. Not difficult, and the most direct exposure to the commodity.

There are several ways to trade gold directly, including physical bars and coins, gold ETFs (exchange-traded funds), and gold futures contracts.

A drawback of trading physical gold, such as coins and bars, is the speed of transaction. Holding physical gold makes more sense from an investment perspective. Storing physical gold also poses security risks, and can generally just be inconvenient.

ETFs like $GLD generally have low transaction fees, are priced in real time, and very liquid. Buying shares of the ETF is getting direct exposure to gold, and for a more leveraged approach $GLD options can be used. There are 2X bull and 2X bear gold ETFs such as Proshares UGL (2x bull) and GLL (2x bear).

The above chart is of $GLL, which is the gold 2x leveraged inverse ETF. Remember that inverse ETFs will usually suffer some kind of decay based on a daily rebalance, and should not be used for long duration holds generally.

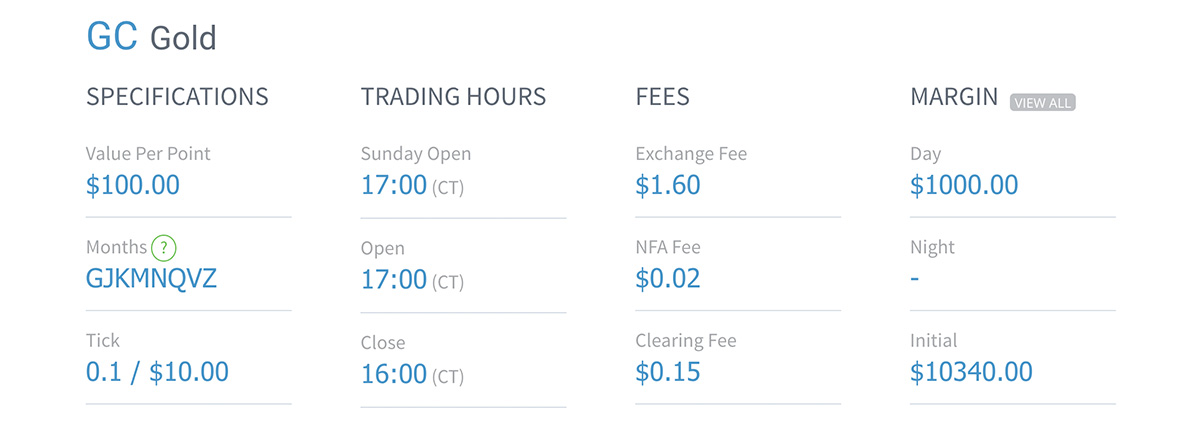

Gold futures are the most leveraged way to trade gold in the /GC Comex market. The leverage there is using about ~$1000 of day margin to have exposure to $230K of notional value (as of April 10th 2024, subject to change as gold prices fluctuate). One /GC futures contract trades in increments of 100 troy ounces of gold. The point value of the /GC contract is $100. So what appears to be a ±$1 move (it’s actually one point), will give ± $100 of position movement on your account per contract in the trade.

Trading Gold Mining Companies

Trading mining companies can offer potentially higher returns than the return on gold itself, especially if the company makes discoveries in mining or develops new efficiencies to reduce costs. Some mining companies also pay dividends, which can provide a steady stream of income. Sounds great, but remember this is not just a commodity like physical gold.

In the example image above NEM (Newmont) underperforms the hard asset (GC futures).

Mining companies are businesses, and their stock prices are impacted by factors beyond just the price of gold. This can include the obvious things like input costs and management decisions. A huge management decision that can impact a mining company and its valuation is their hedged position or lack thereof on the underlying

If ABC mining company tries to hedge future volatility of spot prices in gold and forward sells at $1000/oz, yet the price of gold goes to $2000/oz, don’t expect the mining company to appreciate as gold does. They are limited by their hedge. The hedge would only help bolster the stock price in this case if they had forward sold $1000/oz and the price of gold went to $500/oz.

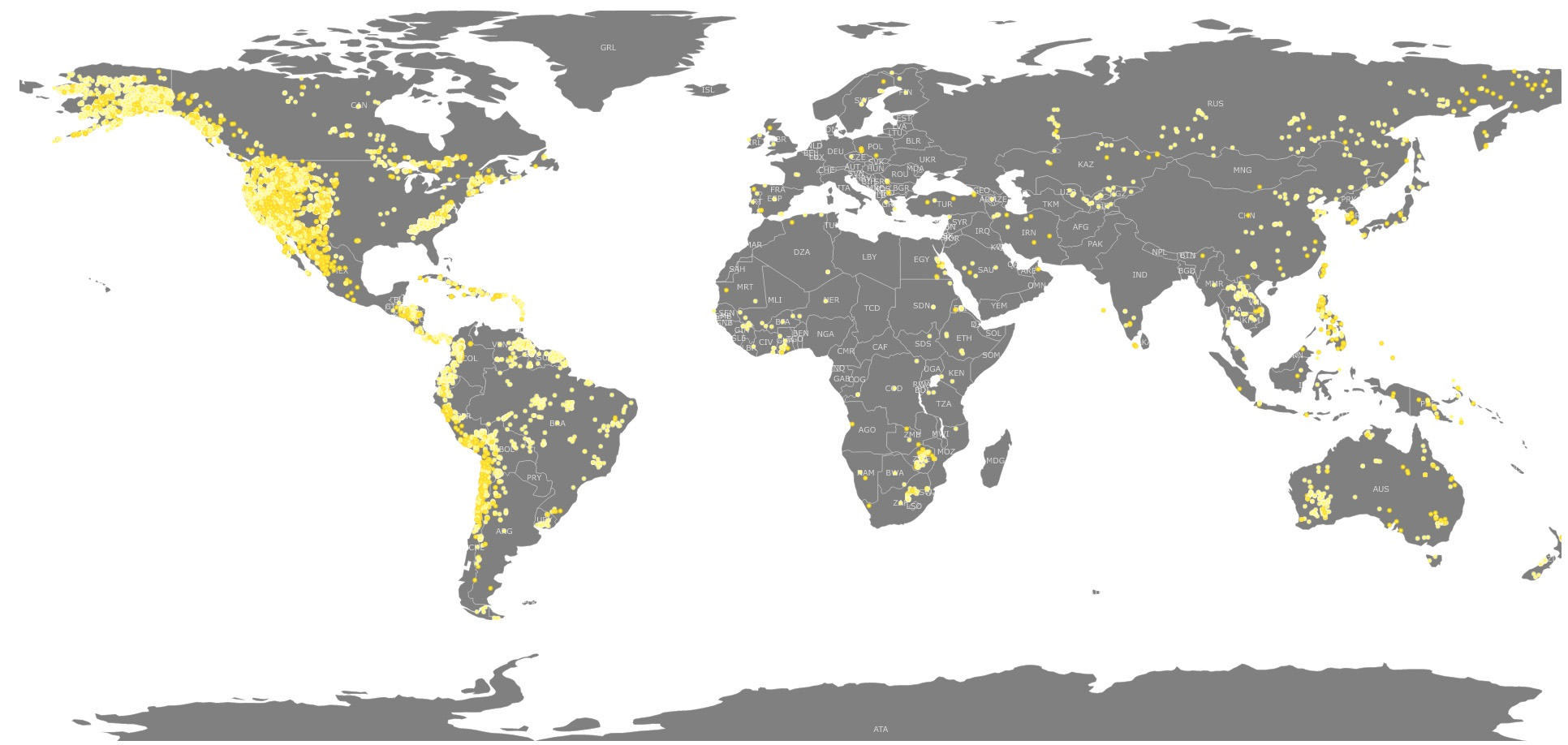

Perhaps a bit more fringe but needing mention is political risk in the countries where they operate. The political risk is magnified in countries that are resource rich, yet underdeveloped based on global north standards. In these areas investment may be regulated more strictly.

Popular Gold Mining Companies and ETFs

Top 5 Gold Mining Companies

- Newmont Corporation (NEM)

- Barrick Gold Corporation (GOLD)

- Freeport-McMoRan Inc. (FCX)

- Agnico Eagle Mines Limited (AEM)

- Nevada Gold & Casinos, Inc. (NGG)

Top 3 Gold Miner ETFs

- VanEck Gold Miners ETF (GDX)

- Direxion Daily Junior Gold Miners Index Bull 2X ETF (JNUG)

- Direxion Daily Gold Miners Index Bull 2X Shares (NUGT)

Before You Invest or Trade

No matter which route you choose, it’s important to do your research before investing in gold or gold mining companies. With the massive breakout taking place now, (article written April 10th 2024) it can be tempting to want to chase gold. However you should have a solid understanding of how gold trades, or acts as a defensive asset in a portfolio before committing to a position. Traders can rely more so on technical analysis whereas gold investors should understand where we are in the macro cycle of the economy.