TradeZella vs. TraderSync: Detailed Comparison Analysis

Choosing the right trading journal can dramatically improve the way you analyze your trading performance. If you can harness your data properly, you’re bound to know what strengths you should lean into, and what weaknesses you should look to improve.

Two popular options on the market are TradeZella and TraderSync. While TraderSync has been around longer, the two stack up quite well, and are top contenders in the space. Let’s have a deeper look at the pros and cons of each.

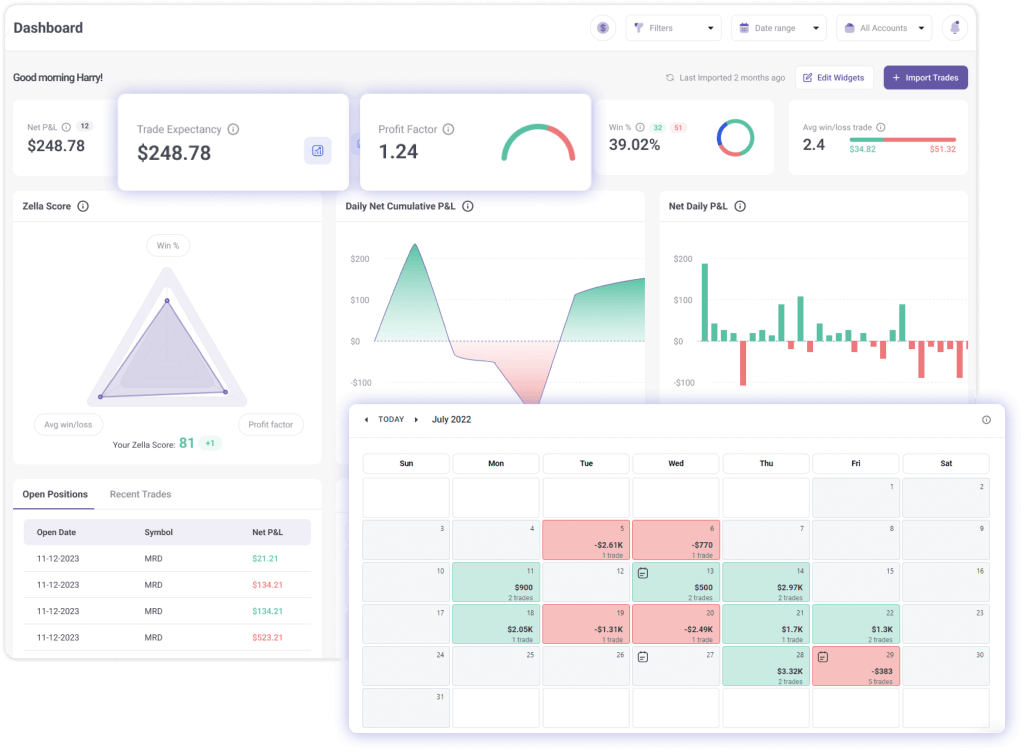

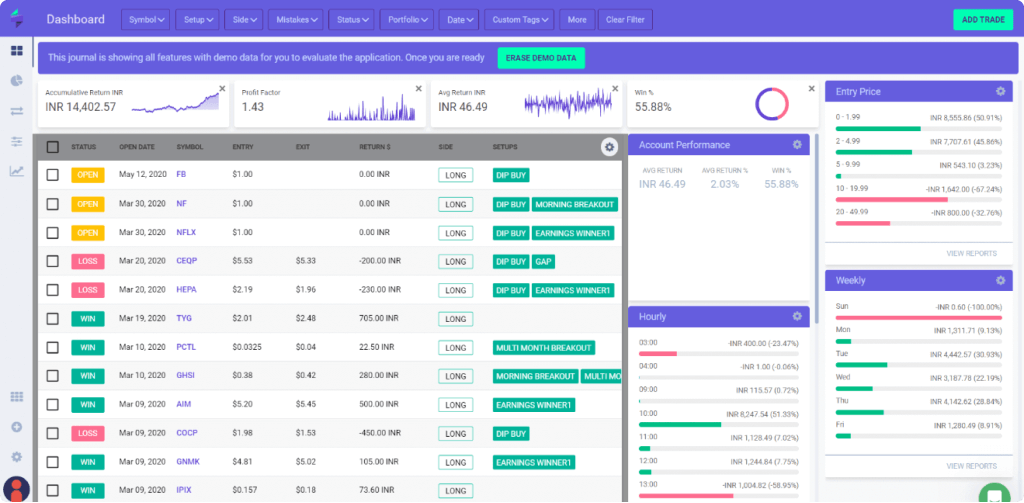

Look and Feel

TradeZella is designed by traders for traders, emphasizing simplicity. The dashboard presents essential data points clearly, minimizing clutter and making it easy for users to focus on key metrics like Trade Expectancy, Profit Factor, and the Zella Score. This streamlined interface allows traders to get started with minimal confusion.

TraderSync is designed by programmers who learned to trade. So there should be no surprise that there is more of an emphasis on technicalities, and a developer’s look and feel. The dashboard is a bit more complicated than that of TradeZella, with much less visual space, and many more colors. This is a preference that some may like or some may not like. A drawback here is that there is not as much ability to customize your dashboard.

Both platforms offer a light and dark mode.

Trade Import and API Sync

No matter what platform you end up using, you’ve got to get your traders in there. Both TradeZella and TraderSync offer manual trade entry, bulk trade import, as well as broker connections through an API.

TradeZella supports 10 brokers currently, which is somewhat underwhelming compared to the 240 tha TraderSync currently supports.

Features

TradeZella’s journaling features make it more than just a place to record your trades, but a place to learn from your data. There is a focus on drill down reporting where the more information you want, the more information you can get. As you develop playbooks and tag trades with playbooks, mistakes, as well as attach context notes, you’ll begin to learn about where your edge really is in the market.

TraderSync offers a wide range of reporting options and customization. You’ll be able to generate reports based on setups, symbols, sectors, and mistakes. However, the emphasis is more on the quantity of reports rather than the depth of analysis. The tags are not the same as the playbook tagging that TradeZella offers. Lots of reports, yes, but not as insightful.

Both platforms offer trade replay, as well as the ability to backtest your strategies. Each option also is in the process of implementing AI to help streamline the feedback loop and simplify the insights to glean from your data.

Sharing and Community

TradeZella and TraderSync offer the ability to share your trades. TradeZella’s mentor and mentee feature allows much more personalized access than a generic share of the trade metrics you’ll find on the TraderSync share feature. You do not need an account with either platform to view shared trades from someone with access.

TradeZella also allows for the sharing of an entire playbook strategy, not just individual trades one at a time. This can be helpful if you’re looking for feedback on the strategy as a whole, and want to crowdsource opinions from different traders. Once again, you do not need a TradeZella account to view a shared Playbook.

Educational Library

The TradeZella University is a well built out video library with videos spanning all topics relevant to trading. It’s not just loaded with tutorials on how to use the platform, but more so how to use the data you are looking at to improve yourself as a trader. Lots of the content is developed by Umar Ashraf, a well respected trader.

TraderSync’s educational library focuses on how to use the platform in more tutorial style videos with less emphasis on how to actually grow as a trader and develop an edge in the market.

Mobile App

As of now, TradeZella doesn’t have a dedicated mobile app but can be accessed via mobile browsers. The minimalist design ensures that the platform remains user-friendly even on smaller screens. There’s not much of a user experience difference on mobile and everything that you’re used to on the web app will easily translate over.

TraderSync offers a mobile app that allows traders to view and manage their trades on the go. If TradeZella had a horrible mobile experience, this would be a more substantial edge, but because TradeZella’s browser version is just as easy to use as an app, not much of a tie breaker.

Pricing

TradeZella has a straightforward pricing model with two tiers; basic and pro. The basic monthly plan costs $29/month or if billed annually, this drops to $24/month. The pro monthly plan is $49/month or if billed annually, this drops to $33/month. The TradeZella basic plan does include all reporting functionality but does not include backtesting, trade replay, or unlimited mentorship mode.

TraderSync offers three pricing tiers: pro at $29.95/month, premium at $49.95/month, and elite at $79.95/month. While the basic plan is cheaper, advanced reports are only available in the premium and elite plan, making it more expensive for full functionality.

Want to get TradeZella at a 10% discount? Use this link: TradeZella – And add code “TB10” at checkout.

Save 20% on TradeZella

TradeZella allows you to harness your trading data and gain actionable insights to becoming a profitable trader. Use code "TB" at checkout.

Summary

Both TradeZella and TraderSync offer powerful tools for traders, but they cater to different needs. TradeZella provides in-depth analysis and features like the Zella Score and Playbook, making it ideal for traders who want detailed insights into their performance. TraderSync excels in broker compatibility and offers lots of types of reports, but not in as much detail. The pricing is a bit more complicated with TraderSync, and to get the most benefit, you are looking at paying a higher price point.

It’s not that one journal is better than the other, they simply cater to different avatars. Wherever you are in your trading journey it’s important that you are taking the steps to accurately collect your trading data and interpret it in a way that helps you improve.