The Power of a Trading Playbook: Boost Your Trading Success

Successful traders do not rely on luck in the market. Successful traders know that it takes a well thought out plan to generate positive expectancy. This is exactly where the trading playbook comes into play. The trading playbook is your personalized strategy to make the right entry, exit, and management decisions at the right time and the right place.

Your Trading Playbook is Your Edge

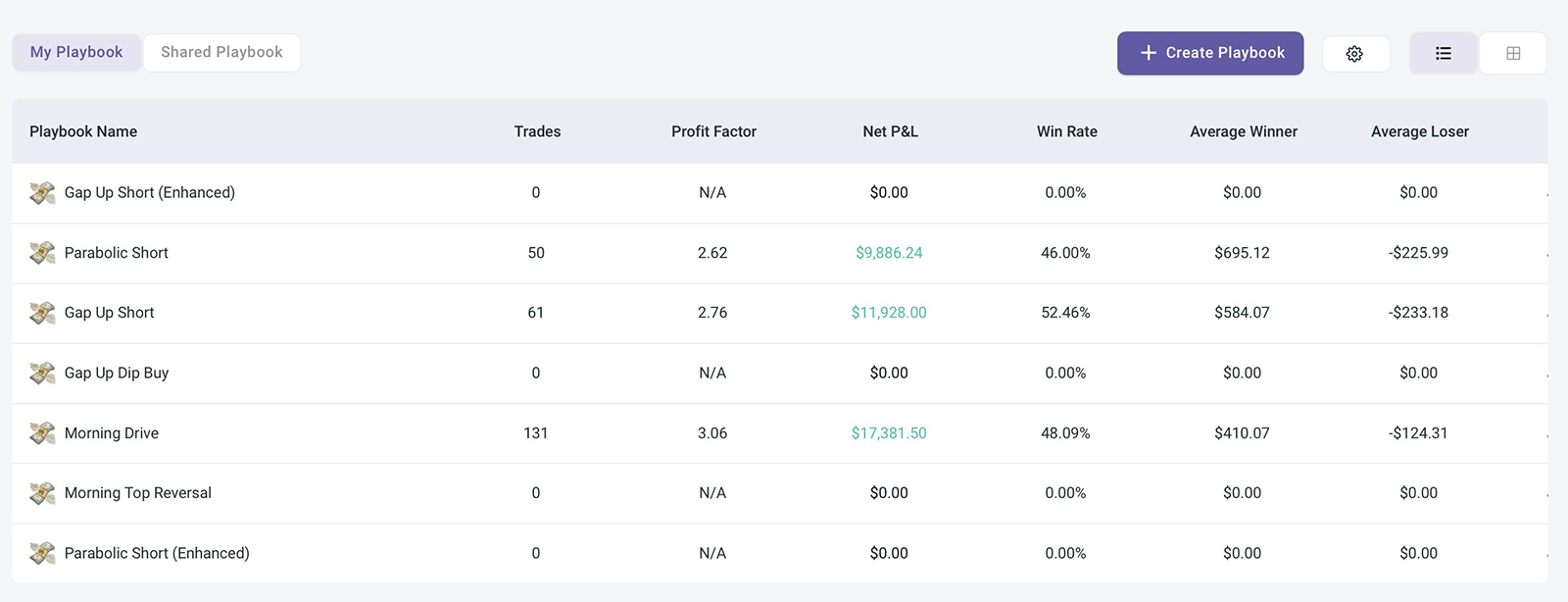

A Trading Playbook is more than just a collection of generic dos and don’ts about trading. It’s a specific approach that defines the setup you are trading, the rules of engagement with that setup, and how to manage your position. By categorizing your strategies into specific playbooks, you’ll be better able to analyze your trades to figure out what works and what doesn’t.

If you do not have a trading playbook, your trading will be sporadic and lack consistency. You’ll never be able to look back at the data and figure out if your accuracy is the issue, if your targets are too small, if your emotions get the best of you, or if there is even a win rate that’s acceptable associated with the strategy.

No trading playbook = no trading edge.

Key Components of a Trading Playbook

Creating an effective playbook involves several key components. Let’s break down what you need:

Pre-market Analysis

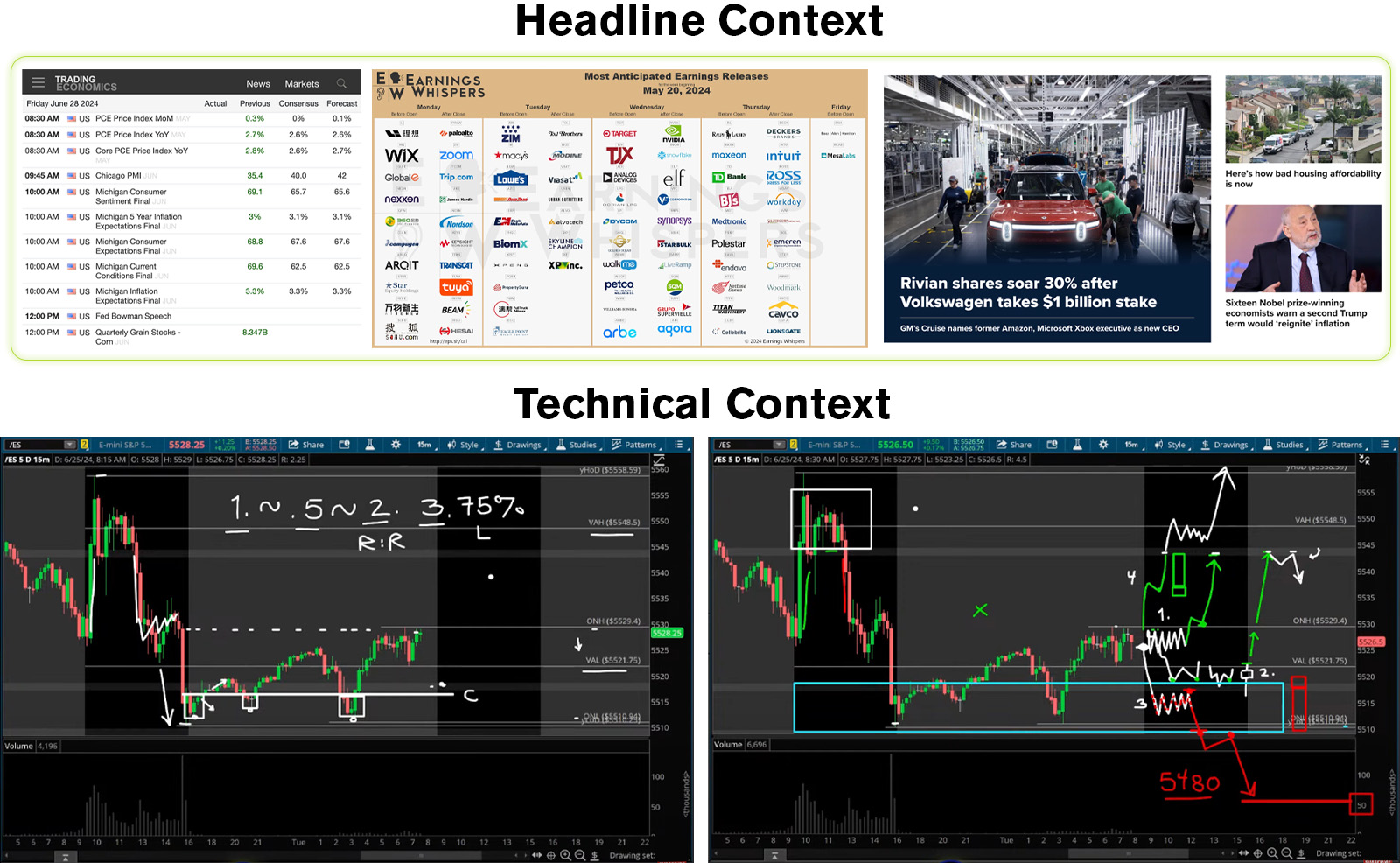

Every day should start with a routine that gives you the proper context for the upcoming session. Its generally a good idea to take a top down approach that considers a really broad perspective, working into a more narrow perspective.

At the Trade Brigade, our morning routine usually looks like this:

- Macro and fundamental news. CPI, PCE, Labor Report, PMIs, FOMC.

- Earnings moves. Are there any notable earnings releases from the prior day or pre market?

- Headlines. Are there any news announcements outside of scheduled events?

- Broad market technical analysis and overnight session check in.

- Stock specific analysis.

In this premarket prep phase, you should be identifying any potential setups that fit your playbook. Are we opening on a gap with a catalyst? Are we opening inside of a balance range with the opportunity to break out? Is the market re-tracing into a key level of interest? Where are we in the trend cycle?

You can think of this phase as the idea generation phase. Your “in-play” watchlist should start to narrow after going through this. In your trading playbook this helps us build context for our triggers.

Triggers

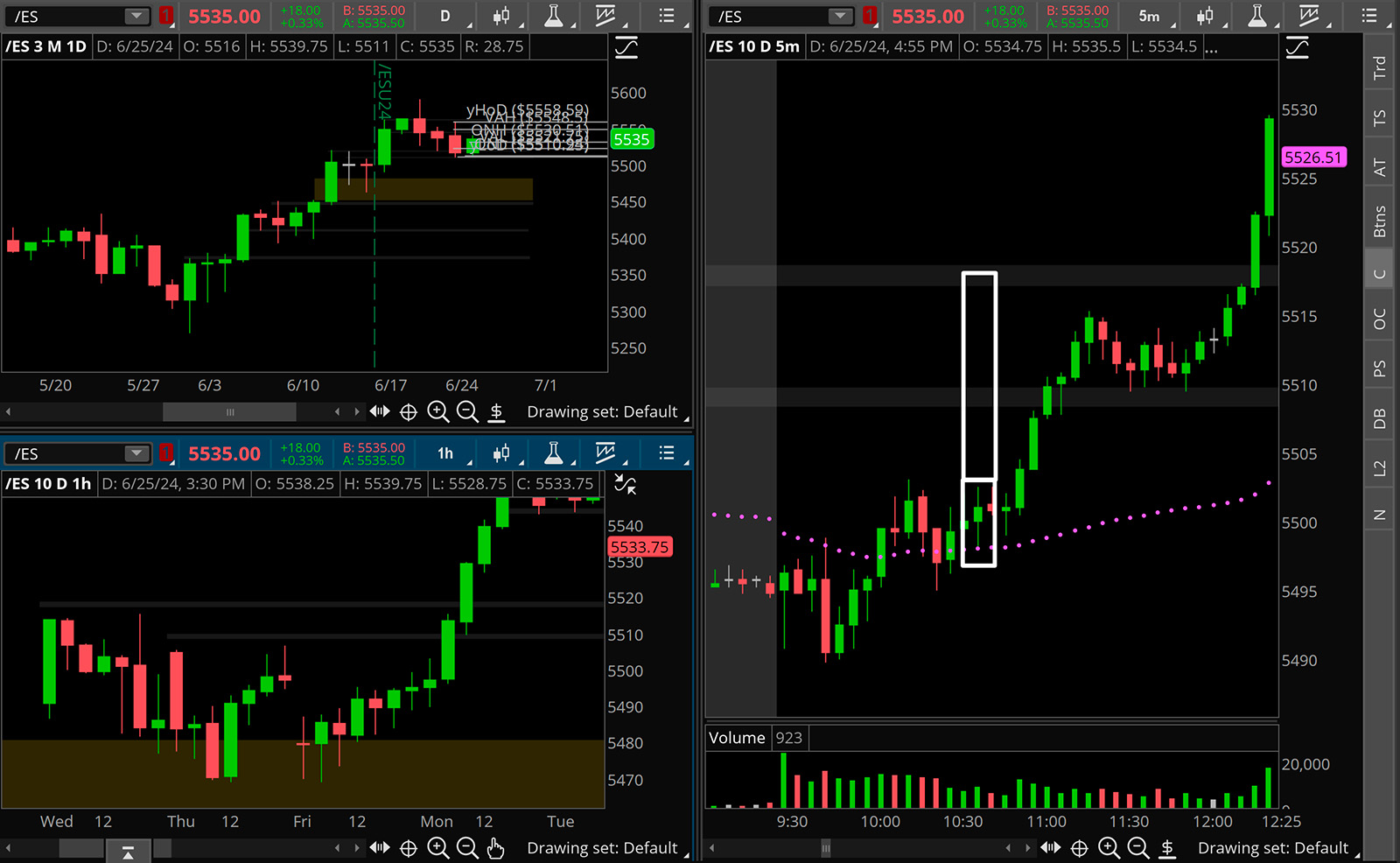

Triggers determine when to take action and when to wait on a specific setup. At the Trade Brigade, our main focus is price action triggers, but do know that there are fundamental, or news driven triggers as well.

A technical trigger describes the exact moment that you click the buy button on a setup. If the criteria is not met, you continue to use patience. Be very specific when it comes to defining your triggers. There should be no ambiguity so that you can replicate the strategy on a consistent basis.

For example, there is a positive catalyst from the pre market session, the daily trend is up, the hourly chart has pulled back to a level of interest, the five minute chart printed a candle of interest. This technical trigger gives us two of the key components of the trade plan. The entry, and stop loss.

Managing Risk

Risk management is what prevents traders from suffering larger losses than they plan for. We just made note that the trigger should also be related to the stop loss. Stops are one component of risk management, however, position size is just as important.

Start buy defining your trading R. If you dont know what this is, its basically one unit of risk. You can read more about the concept here: What is ‘R’ in Trading?

Then calculate the position size you should use based on the stop that the candle of interest is suggesting. If your 1R is $1,000 and your stop is $0.50 from $100 down to $99.5, your position size should be 2,000 shares. This would mean your account needs to be $200k or larger to be properly positioned in this trade.

In the /ES example image below, lets assume the same $1,000 initial risk on 4.75pts. This means for every one contract we are risking $237.5 so we can take 4-5 contracts total to risk around 1R.

Managing And Exiting The Trade

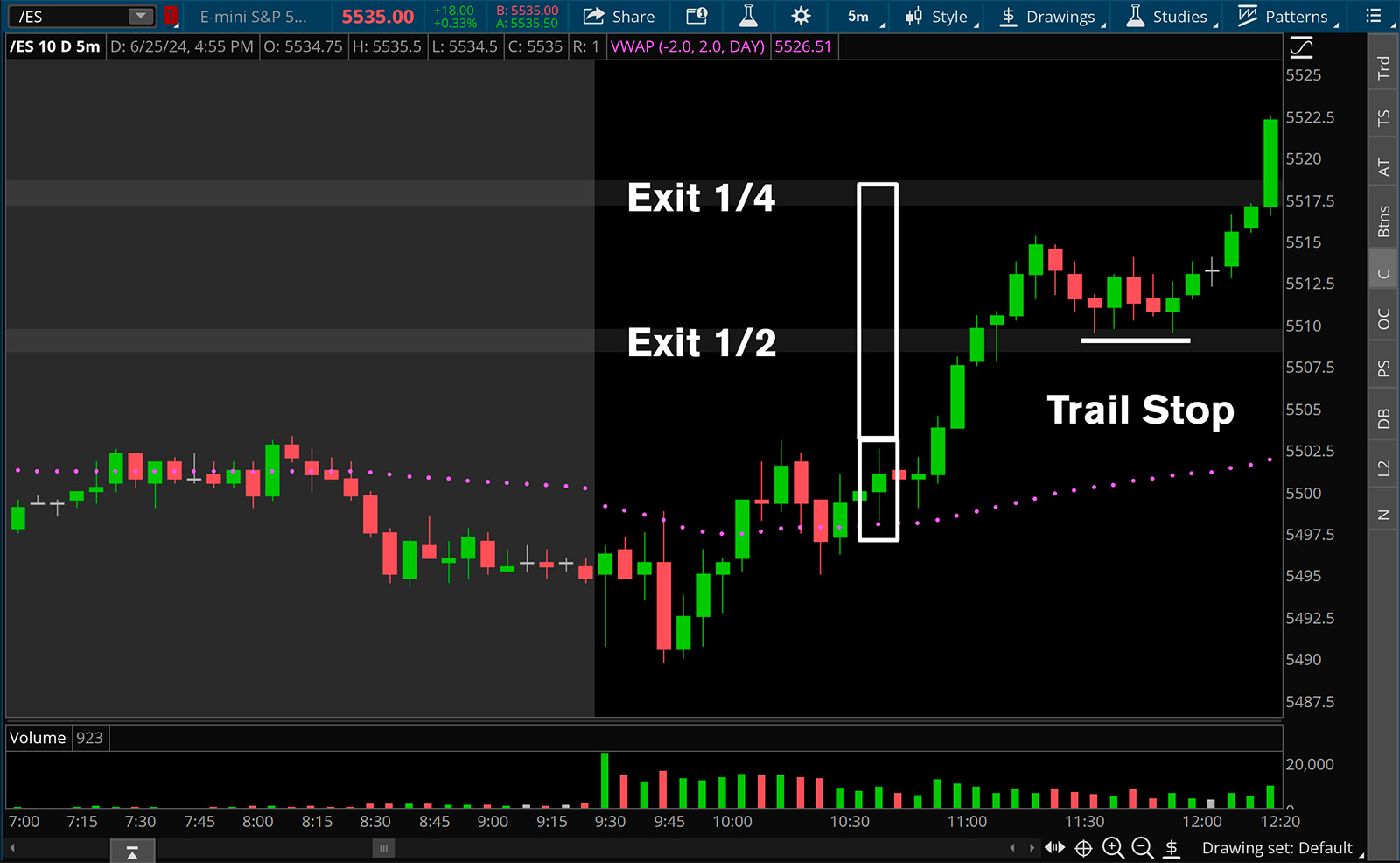

When you enter the trade under the trigger segment you should also have some idea of where the target is. This is what allows you to get into an intended 2:1+ risk reward trade. However when you get to the mechanic of exiting, you should have some additional rules to guide your decision making.

When you get to the target does your playbook tell you to exit 100% of the position? Do you take a mitigation approach where you close partials? Should you move your stop once the trade has been adjusted? This all falls under the umbrella of trade management relative to your exits.

Lets continue with the long trade example used in the triggers segment. Let’s say that the market internals were aligned with the direction of the trade, so mildly bullish. Our trading playbook could state that if we are trading with trend close 1/2 of the position at the first target and hold runners while trailing the stop loss up to the last higher low.

If we were trading in the against the market internals, perhaps we don’t take off 1/2 of the position but rather 3/4 to lock in larger chunk of the position as it moves into profit. Perhaps the stop gets moved up more quickly to protect against reversals.

Your trading playbook should account for all of these nuances and act as a road map to managing the trades you are in so emotions don’t take control. Emotional trading tends to be a losing strategy.

TradeZella’s Trading Playbook Features

You can build a trading playbook in a word document, and track your trades via an excel document. Technically you could link them together on the cloud, or use Google docs and sheets to achieve the same thing hosted on the web. This isn’t the best way though as the system can become cumbersome and the analytics are limited to your competencies in excel.

TradeZella offers a comprehensive trading journal with a literal Trading Playbook feature. With TradeZella, you can easily record, track, and analyze your trades. The platform provides detailed analytics reports, allowing you to harness the power of your data to continuously improve your decision making.

Save 20% on TradeZella

TradeZella allows you to harness your trading data and gain actionable insights to becoming a profitable trader. Use code "TB" at checkout.

Tagging Your Trade Setups

Beyond developing a trading playbook, you can add additional tags that help you develop an edge in your decision making. If a component of your playbook was missing, you can tag something like “missing catalyst.” If over time you notice that these trades massively underperform the trades that do have a catalyst, now you can avoid them entirely, or just choose to scale down. Perhaps it’s the exact opposite. No catalyst is actually better! The only way to know this is to measure this. Custom tags make this possible.

The Importance of a Trading Journal

A trading playbook is one major component of a trading journal. The full trading journal is where you record every detail about your trades. The playbook used, the expectancy, the context of the day, custom tags and more. It serves as a conversation with your past trades, allowing you to learn from your mistakes and successes. Reflecting on your journal helps refine your strategies and improve your performance.

Conclusion

One you understand the basics of technical analysis, a trading playbook is the next step in becoming a serious trader. By understanding the key components, and consistently journaling your trades you can more effectively make progress towards profitability.