The Importance of Risk Management in Day Trading

Part of trading is being wrong. As a day trader, all it takes is one bad trade that spirals out of control to blow up your account. The most important thing separating successful traders from losing traders is simple: risk management. An effective risk management strategy is essential for preserving your trading capital, and achieving long-term profitability. Without risk management, you are effectively treating the market like a casino where the house has better odds. You want to trade like a professional who treats this as a business and takes the measures to ensure success.

Understanding Your Tolerance For Risk

To effectively manage your risk, it’s crucial to understand what it is and how much of it you can bear. Your trading risk is really split into two categories: financial and emotional loss. Financial loss is fairly straightforward and refers to how much money you stand to lose in any given trade. What is less frequently discussed is emotional loss. This is arguably more important than the financial loss.

Emotional capital in trading refers to how clearly you can see the market without clouded judgment from stressful events. A stressful event could be a prior loss from earlier in the day, it could be an inconvenience in your personal relationships, it could be as simple as not getting a full night’s sleep.

Before entering any trade you should ensure that your predetermined financial loss aligns with your emotional capital loss tolerance. For example, if losing $500 is no big deal to you and makes sense for your account size, you won’t be draining excess emotional capital if that trade doesn’t work out. If $500 is a devastating loss, even if your account size can withstand it, that’s too much risk to your emotional capital.

Position Sizing And Max Loss

Once you’ve determined your psychological tolerance for risk, you need to determine the position size your account can handle. A general rule of thumb for beginning traders is that you should risk no more than two percent of your total account value in any trade.

Note that the two percent is your risk, not the total value of the position. Your stop loss, and size define the risk in the trade, not the total cost to enter. For example if you have a $100,000 account, you can risk $2,000 on a trade. You could buy 100 shares of ABC stock at $100 a share and have a total cost for the trade at $10,000. If you place your stop loss at $98, you are technically only risking $2,000 even though the trade is using $10,000 worth of capital. To further illustrate, you could buy 200 shares of ABC at $100 and put a stop loss at $99 to achieve the same risk with a $20,000 position. Buying 50 shares of ABC at $100 means you could place a stop at $60 and still have the same $2,000 risk with a $5,000 position.

Proper position sizing ensures you are not overexposed to any single trade, reducing the impact of potential losses to your trading account balance.

You may also find that you set a daily loss limit for yourself to ensure you don’t run out of emotional capital and start to make bad decisions. Nothing is worse than getting angry at the market and spiraling into a series of bad trades that continuously get worse. This is often referred to as being on “tilt” as Jared Tendler put so well in his book, “The Mental Game of Trading.”

Risk-to-Reward Ratio

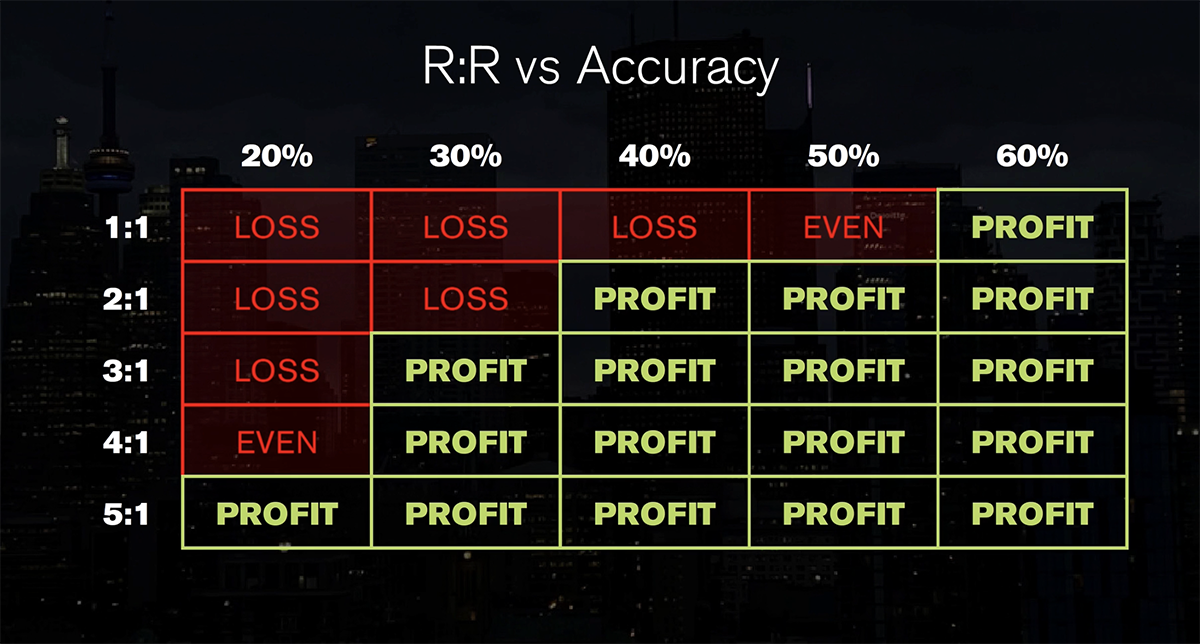

Your risk-to-reward ratio is the next thing to evaluate once you have determined your position sizing in respect to account size. Risk-to-reward (known as R:R) is the relationship between your potential profit and potential loss. A baseline rule is that traders should be taking trades that involve risking 1 to make 2. By getting into trades with favorable risk-to-reward ratios, your profits should outweigh your losses over a sample size of many trades. Not just three trades, not ten trades, but hundreds of trades. The larger your sample size is, the more the math can work in your favor.

Keep in mind that your risk-to-reward ratio wants to be directly tied to your win rate. If you have a 1:2 R:R ratio you need a win rate of 40% or better. If you have a 1:3 R:R now you only need a 30% win rate. These are rough figures, and factoring in outsized losers, fees, and inconsistency in position sizing you would want to err on the side of caution and aim for a slightly higher win rate than what your R:R allows for.

Risk Management Tools

Position size is your first line of defense for risk management. In most traditional trades where you are not short or using leverage, you can only lose what you put into the trade. Beyond that though, we want to use the right order types to manage the risk of our trade once we are already in it.

Stop loss orders should be used in trades and placed under areas of support in long trades, or above areas of resistance in short trades. The stop loss should be trailed higher or lower as new market structure builds out and you can secure more of your profits. Trading without a stop is inherently risky, as the full position size is at risk.

Most modern brokers also offer an OCO order which will ensure that you don’t have a widow hanging in the order queue. For example you can set up a connected stop loss order and take profit order where when one of them fills, the other will be canceled. OCO stands for one cancels the other.

Diversification

Perhaps the last line of defense is diversifying the trades you take. By spreading your capital across different trade ideas, you reduce the impact of an individual trade that doesn’t work out. Diversification in day trading should be thought of as increasing the sample size of your trading dataset. As long as there is a qualified trade setup, the more trades you can take, the better. Think about the outcome of 10 trades vs the outcome of 10,000 trades. The law of large numbers tells us 10,000 trades will present a more accurate depiction of your true win rate. You want more opportunities for your mathematical edge to play out, not less.

Conclusion

Risk management is a core component of any successful day trading strategy. By understanding and managing risk effectively, you protect your trading account, and maintain positive expectancy. Your psychological tolerance for risk is the most important thing to define to ensure you can adhere to the strategy you’re using. Beyond that, position sizing is the next consideration that has a dramatic impact on how you directly control how much you can potentially lose. Consider your win rate and R:R and ensure you are managing trades effectively with the proper stop orders in place to protect downside.

Remember making money is the easy part in trading… keeping it is what separates the winners from the losers.