SPX vs SPY: What’s The Difference?

The SPX and SPY are both measurements of the value of the Standard & Poors 500 index. This is the index that tracks the performance of the top 500 large-cap companies listed on the US stock exchanges. The SPX tracks the theoretical value of the index, but is not actually a financial product that has any holdings. Think of it as simply a numerical value. The SPY on the other hand is an passively managed ETF that holds the underlying 500 companies based on market cap weighting that make up the S&P 500.

What is the SPX

As mentioned above the SPX is a calculation of the S&P 500’s theoretical value. It does not have any holdings, and instead its “value” is just a mathematical expression of all 500 companies weighted average in the index.

Because of this you can’t actually trade shares of the SPX. Without shares, we also have no dividends in the SPX. Instead investors or traders looking to interact with the index can use SPX options. Options listed on the SPX are cash settled and there is no delivery of shares. The average daily volume on the SPX is 2.5 million contracts, all inclusive of calls and puts. Even though there are no shares, the options market still works in the same fashion of having a 100x leverage. Because of this the notional value of the options market in the SPX makes it one of the largest in the world.

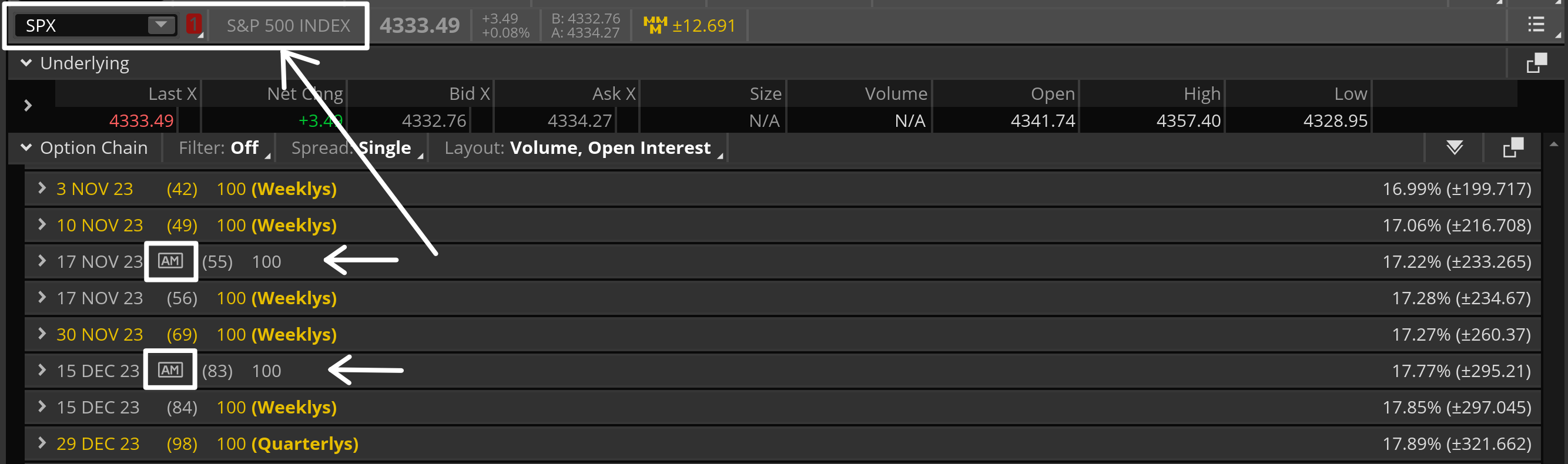

SPX options have daily, weekly, and monthly expirations. Daily expirations, commonly referred to as weekly expirations (SPXW), settle in the afternoon and is the common name for intra-week expirations, not just the Friday. The monthly options expire on the third Friday of the month and are settled in the morning session. Usually on the options chain you’ll see an ‘(AM)’ next to the series expiration. SPX options are only able to be exercised at the expiration date, commonly known as European exercise style.

What is the SPY

The SPY on the other hand is more than just a benchmark index. It is a passively managed ETF that holds the underlying stocks that make up the S&P 500 index according to their market cap weighting as outlined by S&P Global. This means that shares of the ETF can be bought and sold and traders will have actual exposure to the underlying components. With this exposure, the SPY ETF also pays out a dividend based on the dividend of the underlying components. The trading activity of an ETF has been found to have no meaningful impact on the underlying components price, especially in a passively managed ETF.

Just like other tradable ETFs, the SPY has an options market. The SPY options market, although having a notional value less than that of the SPX, is the most liquid options market in the world. Compared to the SPX trading 2.5 million contracts a day, the SPY trades somewhere closer to 10 million contracts, all inclusive of calls and puts, every day. This means that the options market in the SPY is going to have tighter spreads, and trade more efficiently.

Because the SPY has shares available for trade, SPY options settle via shares not cash. SPY options also have frequent expirations, daily, weekly, and monthly. SPY options are available to exercise any time prior to the expiration, known as American style. All SPY options are settled after the market closes, and never before.

The Differences Between SPX and SPY

Because both SPX and SPY give us a feel for the value of the S&P 500, traders can sometimes use the terms interchangeably. There’s no harm in doing so when simply referring to if the market was up or down, but as a trader, its extremely important to know if you are referring to the ETF or the theoretical index for a number of reasons.

Settlement

SPX options are a cash settled product. This means that once the trade expires, there is no risk left in the trade. A cash settlement pays the buyer if the trade is in the money at expiration, or if it is out of the money, the premium paid is lost. In the SPY, at expiration shares are delivered of the underlying, which means that risk continues to be on the table even after the trade is “over.” This risk premium explains why on a relative basis, SPY options are more expensive than SPX options.

Liquidity

The SPX is 10 times as big as the SPY. This means that the options are 10 times more expensive. To get involved a trader needs a larger account. The more expensive barrier to entry means that SPX options are typically less liquid than the SPY ETF options. Traders looking to scalp options need to be aware that the options spread is likely going to be larger in the SPX for this reason, and slippage should be considered.

Tax Implications

Trading SPX options is tax advantaged. Although we are not CPAs, the general rule of thumb is that the 60/40 rule applies to the index options instead of the SPY ETF options. This means that 60% of your gains are taxed under the more favorable long term capital gains rate and 40% are taxed under the more aggressive short term capital gains rate. Always consult a registered professional for any tax advice.

Differences in Price

The million dollar question that most S&P traders want answered is why the SPY and the SPX does not track precisely. In a perfect world the SPY would trade at exactly 1/10th of the SPX price. The primary reason comes down to dividend payouts from the SPY. Companies that pay out on a non quarterly schedule have dividends that get paid into a sitting fund in the SPY before being paid out to shareholders of the ETF. There are also very small management fees that are charged by the SPDR fund to “host” the SPY. These differences are negligible and should not impact your decisions. The largest spread typically between the two is $1.70 on a relative basis.

A great rule of thumb is to always watch the instrument that you are trading, and not try to build an edge focused on exploiting the spread between the two. One does not lead the other, and vice versa. As you can see the spread between the two is the least pronounced right before the dividend payout, and is most pronounced when the dividend is paid.

Conclusion

In summary, both SPY and SPX offer exposure to the S&P 500 index, but they differ in structure, liquidity, dividend treatment, and tax considerations. SPY is an ETF that can be traded like a stock and pays dividends, while SPX is the index itself and can only be accessed through options trading.