Comprehensive Guide to Options Trading for Beginners

An option is a financial derivative that provides the holder (buyer) with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date). Options are used by investors and traders for hedging, speculation, and income generation. Underlying assets could be individual company stock, shares of ETFs, forex pairs, commodities, or even real-estate.

Options are commonly displayed in a “chain” where we can visualize many different descriptive factors that we will explore in this article.

Understanding Options

Options can be categorized into two main types: calls and puts. Call options give the buyer the right to buy the underlying asset at the strike price. In this case, the buyer of the call option is bullish on the underlying asset, while the seller of the call option is bearish on the underlying.

Put options grant the buyer the right to sell the underlying asset at the strike price. In this case, the buyer of the put option is bearish on the underlying asset, while the seller of the put option is bullish on the underlying.

Options have a standard contract size where each option contract represents the right to buy or sell 100 shares of the underlying stock. So in the options chain, when you see the quote for an option at $5.00, the price you actually pay is $500, due to the 100x multiplier.

Options Risk Metrics (The Greeks)

Options risk metrics, often referred to as “the Greeks,” are variables that measure the sensitivity of an option’s price to changes in factors like the price of the underlying asset, time to expiration, and volatility. The main Greeks include:

- Delta – How much a $1 move on the underlying will impact the options price

- Gamma – How much a $1 move on the underlying will impact the options Delta (see above)

- Theta – How much value the option will lose per day

- Vega – How much a 1% implied volatility move will impact the options price

These metrics can be useful to traders who take a more quantitative approach to trading, but are not very useful to traders who are taking very short term positions with options. If asked which of these are the most important for short term trading it would be Delta and Theta.

Differences Between Going Long and Short Options

Going long on an option, involves buying an option contract with the expectation that its value will increase, allowing you to profit from price appreciation. Keep in mind, even if you want the underlying stock price to go down, you are a put buyer and want your contract value to go up. Long options positions carry limited risk, as the most you can lose is the premium amount paid.

In contrast, going short on an option involves selling an option contract to open the position with the expectation that its value will decrease, allowing you to profit from price depreciation. An options value is always depreciating due to Theta, and any gains on the contract come from a favorable movement in price on the underlying asset. Options sellers are also known as premium collectors, or “writers” of options contracts. Short options positions carry unlimited risk.

Most Popular Options Terms to Know

- Premium: The price paid to purchase an option contract.

- Strike Price: The price at which the underlying asset can be bought or sold.

- Expiration Date: The date on which the option contract expires.

- In-the-Money (ITM): An option that has intrinsic value.

- Out-of-the-Money (OTM): An option that has no intrinsic value.

- At-the-Money (ATM): An option whose strike price is equal to the current price of the underlying asset.

- Intrinsic Value: Difference between the current price of the underlying asset and the option’s strike price.

- Extrinsic Value: Additional value of an option beyond its intrinsic value, representing factors such as time until expiration and implied volatility.

Advantages and Disadvantages of Trading Options

Options trading’s largest advantage is the potential for leveraged returns since there is a 100x multiplier on the contracts. If you are just going long options you have limited and defined risk, only able to lose the premium paid for the position. As the term option would imply, there are also lots of strategies that can be used to create complex spreads to achieve very specific objectives.

However, options trading also carries risks. It would be insane to not acknowledge that the largest advantage is also its largest drawback. You can generate positive leveraged returns, but just as quickly generate negative leveraged returns. This makes options trading a double edged sword, where risk management strategies really are the best line of defense to prevent large losses.

How are Options Different from Futures?

Options provide the holder with the right, but not the obligation, to buy or sell an underlying asset, while futures obligate the buyer and seller to buy or sell the underlying asset at a predetermined price and date. Additionally, options have limited risk for buyers, while futures have unlimited risk for both parties.

Real World Examples

Bullish Scenario with a Call Option:

Imagine you believe Apple’s stock is ready to break out to the upside. The current trade price of AAPL in this example is $95. You could buy a call option with a strike price of $100 expiring in 3 months for $12.50. Remembering that the options contract has a multiplier of 100, this would mean you pay $1250 for the position.

If AAPL stock price rises to $120 by expiration, your call option will be “in-the-money” and hold intrinsic value. You can exercise the option to buy 100 shares of Apple stock at $100 (the strike price), and then immediately sell them in the market for $120, profiting from the difference. Or prior to the expiration, you could sell the option contract as it gained value while the underlying price of AAPL was moving in the upward direction.

Bearish Scenario with a Put Option:

Let’s say you’re concerned about a potential price drop in Microsoft’s stock, which you currently own. To hedge your long position and protect your downside, you could buy a put option with a strike price of $100 expiring in 2 months. If the stock price tanks to $70, your put option will be profitable. You can exercise it to sell 100 shares of MSFT for $100 (the strike price), even though the market price is lower, limiting your losses.

This is an example of using options to hedge an existing position, traders could trade the put option contract just like the AAPL example without owning shares of MSFT already.

Generating Income with Covered Calls:

If you already own 100 shares of a stock (like MSFT from the previous example), you can generate income by selling (writing) a call option contract with a strike price slightly above the current market price. You collect the premium for agreeing to sell the stock at the strike price if the option is exercised by the buyer. If the stock price stays flat or dips slightly, you keep the premium as income and keep the pre existing position. However, if the stock price significantly exceeds the strike price and the option is exercised, you’ll be forced to sell your shares at the lower strike price, missing out on the potential for further gain.

Traders interested in repeating this cycle should look into the wheel strategy here.

Advanced Strategies

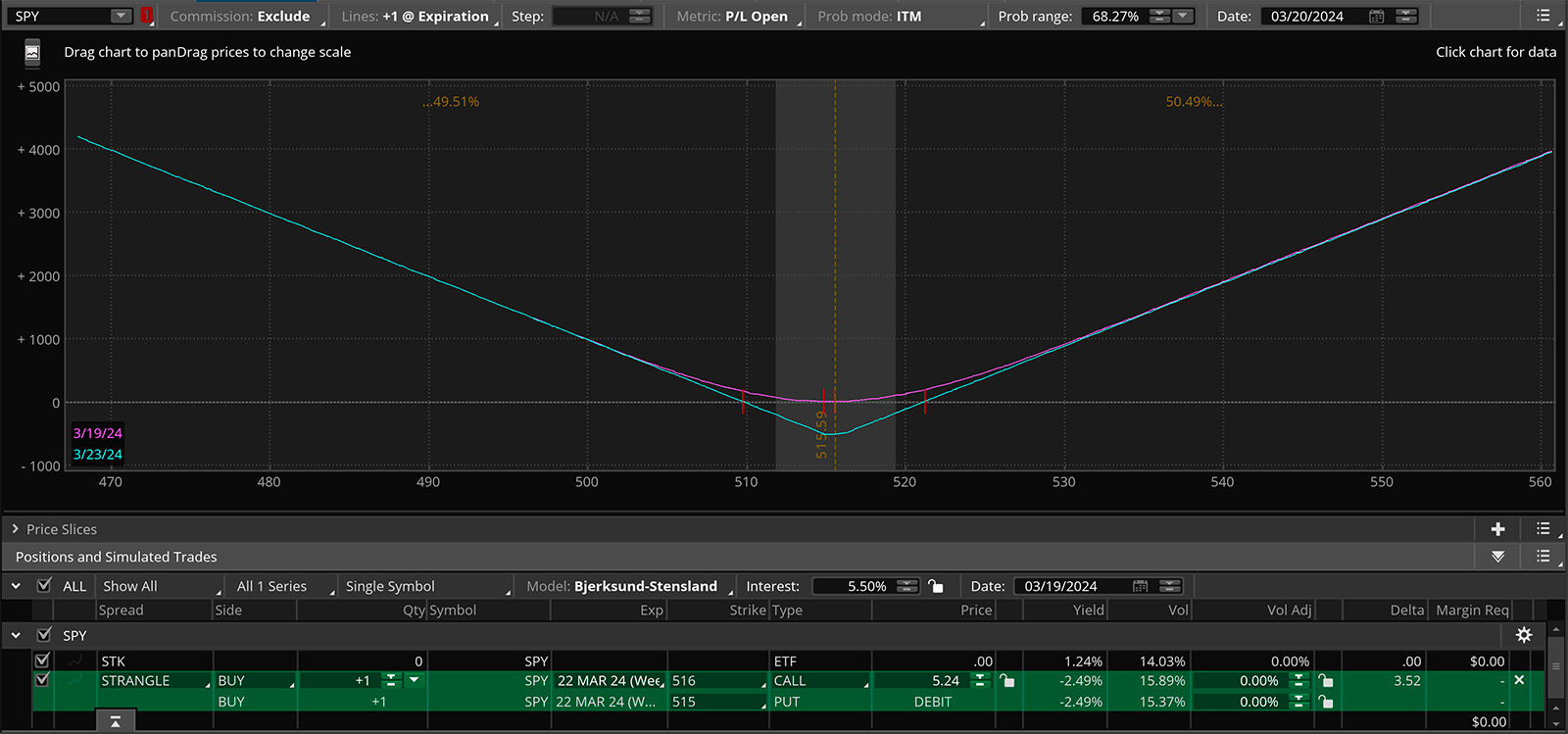

Straddle and Strangle:

Straddles involve buying both a call and put option with the same strike price and expiration. Strangles are similar but with different strike prices (one higher, one lower than the current market price). These strategies benefit from significant price movements in either direction but require a larger upfront investment compared to basic calls or puts.

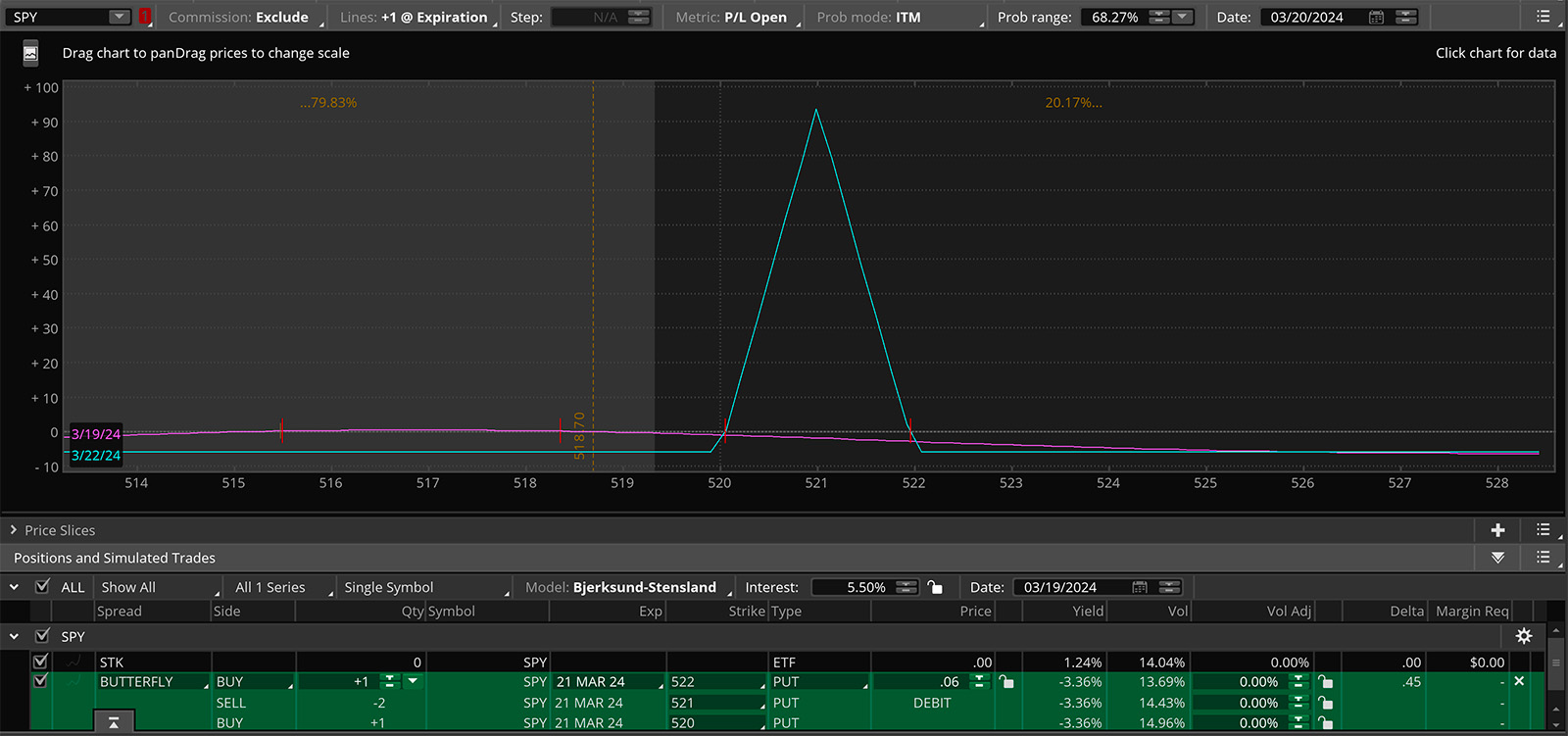

Butterfly Spreads:

Butterflies are a multi-leg options strategy designed for limited risk and capped profits. They are considered neutral strategies, meaning they profit most if the underlying asset price stays relatively flat around the strike price chosen for the spread. Butterfly spreads involve four options contracts on the same underlying asset with the same expiration date, but three different strike prices.

Here’s how a basic butterfly spread works (using a bull butterfly spread as an example):

- Buy one call option with a lower strike price (far out-of-the-money).

- Sell two call options with a middle strike price (at-the-money or slightly in-the-money).

- Buy one call option with a higher strike price (far out-of-the-money).

Imagine the butterfly spread visually plotted on an options price chart. The resulting graph would resemble a butterfly’s shape, with the middle portion higher due to the two sold calls, and wings on either side due to the one call option bought on both the lower and higher strike prices.

These are just a few examples of more esoteric spreads, and there are many other option strategies available. If you want to get crazy, look up the jade lizard…

Conclusion

Options are a leveraged derivative in financial markets that give the buyer the right, but not obligation, to buy or sell an underlying asset at a given price, at or before a given date. While options present opportunities for leveraged returns it is critical to approach the options market with respect and implement effective risk management strategies to mitigate potential losses. For more follow up check out this article on options with zero days until expiration.