How to Stop Overtrading: 5 Simple Tips

Overtrading happens to the best of us. The session begins, and you know what you should be looking for based on your pre-market plan. Next thing you know it’s the lunch hour, and you’ve taken way more trades than you planned on taking. You’ve flipped flopped back and forth, stopping out, taking quick profits, and really haven’t made much progress on net P/L, or even worse are uncomfortably down on the day. In a fit of frustration, you continue to try to win back your losses all the way until the closing bell.

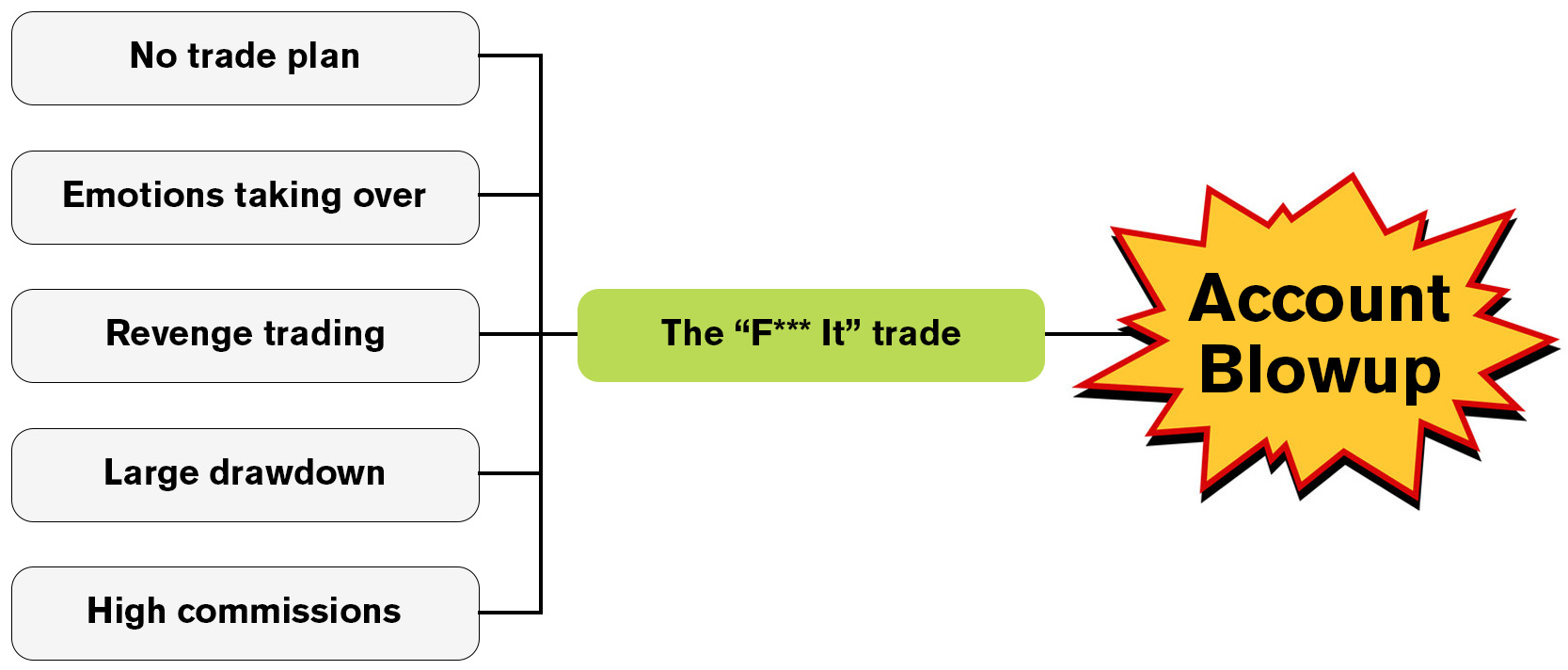

Not only have you lost sight of your trading plan when this happens, but you’ve lost sight of emotional control. The combination of these two things often leads to overtrading and larger than average losing days. As traders, we must be able to identify overtrading, and create cues to stop overtrading before it spirals out of control.

What is Overtrading?

Overtrading occurs when a trader makes excessive trades, either in frequency or size. If you normally have 5 trades a day, 10 or more is overtrading. A scalper with normally 100 trades per day, might be overtrading at 150 trades per day. You could also overtrade your position size. This means if your 1R is typically $1000 and you start over leveraging to 3R per trade at $3,000 you’re guilty of overtrading.

This behavior is often the result of emotional reactions, such as fear of missing out (FOMO), impatience and boredom, trying to recover losses, or generally the lack of a trading plan. overtrading is a form of being on tilt where it becomes very easy to blow up your trading account in a single session. To read more about this concept check out Jared Tendler’s Mental Game of Trading.

Signs of Overtrading

Recognizing the signs of overtrading is the first step in addressing the issue. Here are some common indicators:

- Frequent Trades: Identify the number of trades you normally take in a day. Are you beyond that?

- Emotional Trading: Are you entering to get revenge on a prior trade? Are you being greedy?

- Breaking the Trade Plan: Are you trading without a clear entry, stop, and target map prior to pressing buy?

- Too Much Screen Time: Are you staying at the screens for more than an hour or two at a time?

- Abnormal Size Loss: Are you having losers larger than your average losing trade?

Strategies to Avoid Overtrading

Develop a Solid Trading Plan

A well-defined trading plan is your best defense against overtrading. Period. If you are doing anything other than trading your playbook, that constitutes overtrading.

Entry and Exit Criteria

Clearly define when to enter and exit trades. Do you have technical triggers, fundamental triggers, news driven triggers? What is the market context? All of these things should be well outlined in each of your trading playbooks and make it crystal clear when you should be trading and even more importantly when you SHOULDN’T be trading.

Risk Management Rules

Set rules for how much you’re willing to risk on each trade. This should be your R as defined earlier. If you are trading outside of your R, it’s a tell tale sign that you’re starting to go on tilt. The trade playbook should include the only reasonable times to size up or down on a particular setup.

Trading Goals

Establish short-term and long-term trading goals. If you are aimlessly trading, you’ll lack focus and the ability to adhere to the trading playbook. Aimless trading is sporadic and often rooted in emotional decision making.

Here are 5 additional tips for how to stop overtrading:

Focus on Quality, Not Quantity

Focus on the pareto principle in your trading. Remember that 20% of the actions you take are generally going to be responsible for 80% of the returns you make, or even more powerful… 80% of the mistakes you make. If you can amplify the 20% that drive return, and minimize the 20% that cause drawdown you’ll be well on your way to mitigating the actions that will lead to the spiraling nature of overtrading.

Use the Sticky Note Method

The sticky note method is using a physical reminder to regulate the trades you take. The best method uses a literal sticky note 3×3 square that you place on your monitor directly next to the buy or sell button. On the sticky note, write one of your triggers that causes you to go on tilt. If you consistently fall victim to revenge trading, perhaps you write something like, “Do not press if angry.”

It sounds elementary, but this method forces you to look at the note, and remind yourself of what you need to avoid to make progress. If you still click the button after that there is no one to blame but yourself. Some people like to frame a physical dollar bill, have something sentimental taped to the monitor… it could literally be anything that makes you think twice about your entry in a good way.

Higher Timeframe Management

When you initiate a trade you are typically going to be finding a precision entry point on a smaller time frame chart. This is fine for honing in the entry, however when it comes to the management of the position, you should always be on the entry time frame or higher. There is no sense in entering a trade on the 15 minute chart and then managing it on the 1 minute chart. You’ll be more likely to break from your trade plan and make an emotional decision when zoomed in so far.

Schedule Screen Breaks

It’s important most mornings to catch the first hour of trade. However after that the market typically slows down and it’s not as pertinent to spend every single moment in front of the computer. Setting alerts at price levels is a great way to only get back to the screens if there is a setup that is actually in play. If you are a technical trader, setting candle close alarms is also a good idea. If your triggers require 15 minute closes, you can take 10 minute breaks and check back in as bars are about to close. Hourly closes? Take 30 minute breaks.

Regular breaks can help you maintain a clear mind and prevent forcing setups that aren’t actually there. Step away from your trading desk periodically to recharge, refocus, and

Keep a Trading Journal

Documenting your trades in a trading journal allows you to analyze your trading habits. Recording details such as entry and exits, trading playbook used, emotional state, and market conditions will help you hone in on the 80/20 rule that we discussed earlier. If you notice that your trading takes a hit during the lunch hours for example, perhaps its best to just avoid that timeframe in general.

Benefits of Avoiding Overtrading

When you stop yourself from overtrading, you’ll build a positive feedback loop. You won’t fall victim to large drawdowns as frequently. You’ll see the charts with more clarity. Youll have less stress around trading. You’ll execute better.

All of this positivity reinforces itself, and will encourage you to keep up the good habits.

Conclusion

Overtrading can ruin your trading success. The worst thing that can happen is getting into tilt mode, blowing up an account, and who knows beyond that… By developing a solid trading plan, focusing on quality not quantity, using physical reminders, higher timeframe management tactics, taking breaks, and tracking your trading journey in a trading journal, you can avoid the pitfalls of overtrading.

Remember, trading is a marathon, not a sprint. It takes focused effort to make meaningful improvement. If you’re reading this article, you’re one step closer to being intentional about your learning curve and getting better. Keep going, and stop overtrading!