TradeZella’s Trade Journaling Tools

One of the core features that sets TradeZella apart from other platforms is its comprehensive trade journaling tools. These tools are designed to streamline the process of recording trades, making it easier for you to track your performance and gain insights into your trading habits. The easier it is to harness your data, the easier it is to refine your trading skills.

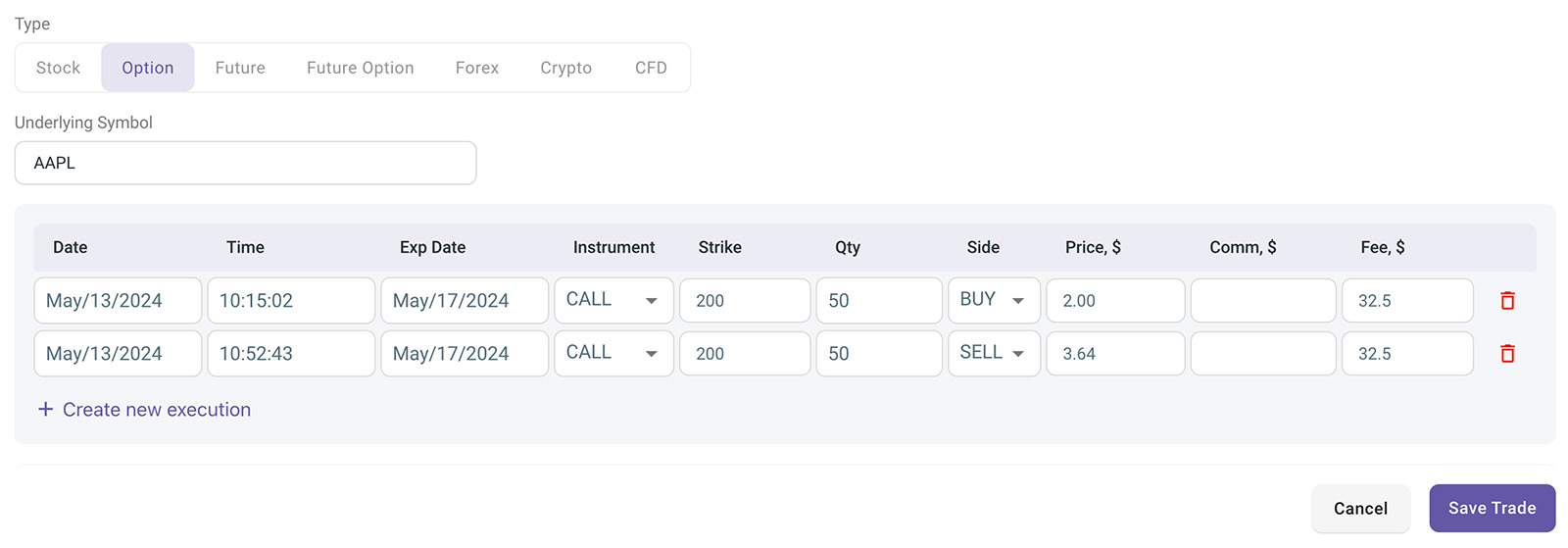

Manual Trade Entry

TradeZella offers a simple and intuitive way to manually enter trades. You can input details such as the stock ticker, entry and exit points, trade size, and any notes you wish to include. This works for not just stocks, but also options, futures, forex, and even crypto. If trading options, you have the ability to input the exact contract strike and expiration you traded.

This method of trade entry allows for a high level of detail and personalization, ensuring that each trade is documented accurately. Manual entry can be particularly beneficial if you want to capture specific nuances or strategies used in each trade.

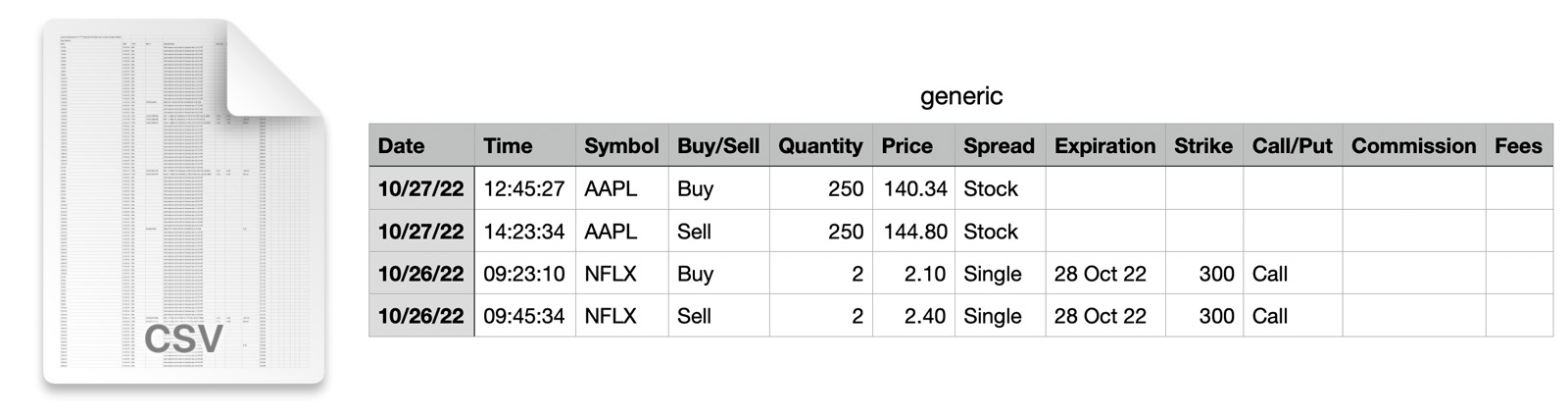

Bulk Upload Feature

For traders who execute a high volume of trades, TradeZella’s bulk upload feature is a game-changer. This feature allows users to upload multiple trades at once using supported file formats like CSV or Excel. TradeZella supports the default CSV files from 35+ platforms. This includes the common choices like Think or Swim, Interactive Brokers, Tradovate, Lightspeed, and yes… even Robinhood.

To upload your own personal CSV or Excel data, you format your trade data according to TradeZella’s guidelines and upload the file. The platform will process your data and add the trades to the journal. Bulk uploading saves time and reduces the risk of errors that can occur with manual entry.

Broker Connection Automatic Sync

If you want your latest data to constantly be feeding to TradeZella, you can directly link your broker if the connection is supported. Currently the platform supports the following 10 broker connections with more on the way. TradeZella will automatically pull your trades every three hours, unless you tell it to sync manually.

The 10 brokers TradeZella currently supports are: Charles Schwab, cTrader, DXtrade, Interactive Brokers, MetaTrader 4, MetaTrader 5, Robinhood, TradeLocker, TradeStation, Tradovate.

Save 20% on TradeZella

TradeZella allows you to harness your trading data and gain actionable insights to becoming a profitable trader. Use code "TB" at checkout.

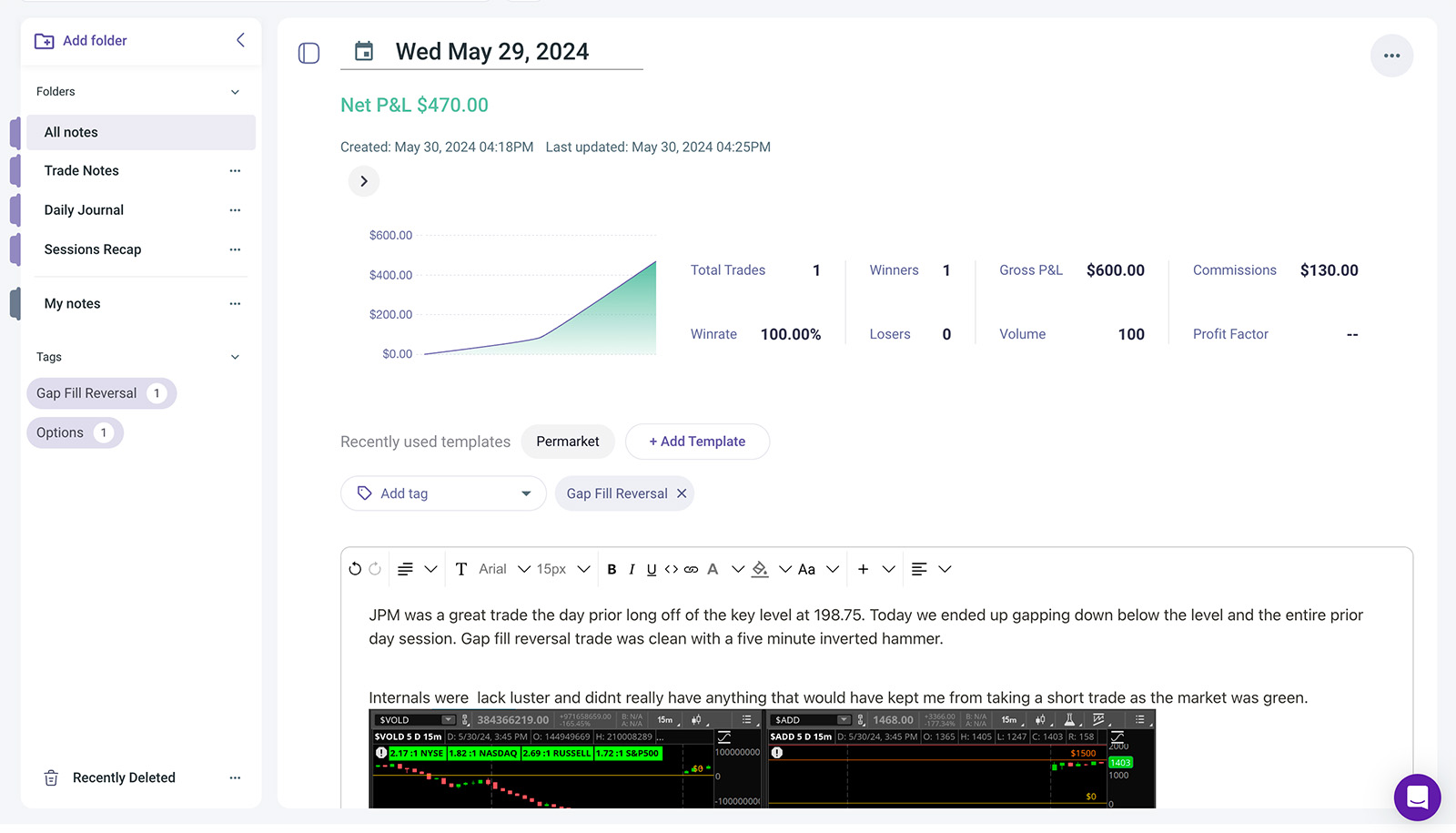

Automatic Data Organization

One of the best parts of TradeZella is the ability to categorize and store your trades and all of the information about them in an easy-to-navigate format. You can filter for your trades by date, type of trade, if it is still open or closed… The options are nearly endless. We mean that quite literally, as you can make an unlimited amount of custom tags to apply to trades.

You can also input more data in the form of notes about each particular trade, about each particular day, or any particular session. A session simply means a custom timeframe that you set. TradeZella’s notebook feature can contain text, images, code snippets, and links.

Organized data is what can make or break your trading system when working on building your trading edge.

User Interface

The user interface of TradeZella is clean and intuitive, making it easy for you to navigate and utilize. The dashboard provides an overview of recent trades and key performance metrics, while the detailed trade log allows for in-depth review and analysis of individual trades. The interface is very easy to navigate without getting bogged down by complicated menus or cluttered screens.

Conclusion

If you’re really looking to develop or refine your edge, understanding your data is the start. TradeZella’s trade journaling tools are designed to make the documentation and analysis of trades as seamless as possible. Whether through manual entry or broker connection, you can maintain detailed and organized records of your trades. Start using TradeZella today and take the first step towards more effective trade documentation and analysis.