Understanding Stock Splits

Stock splits and reverse stock splits are used by companies to manage the price of shares and the number of shares outstanding on the market. They are mechanics to influence investors’ perception of the stock based on its price, without actually changing the value (market cap) of the company.

What is a Stock Split?

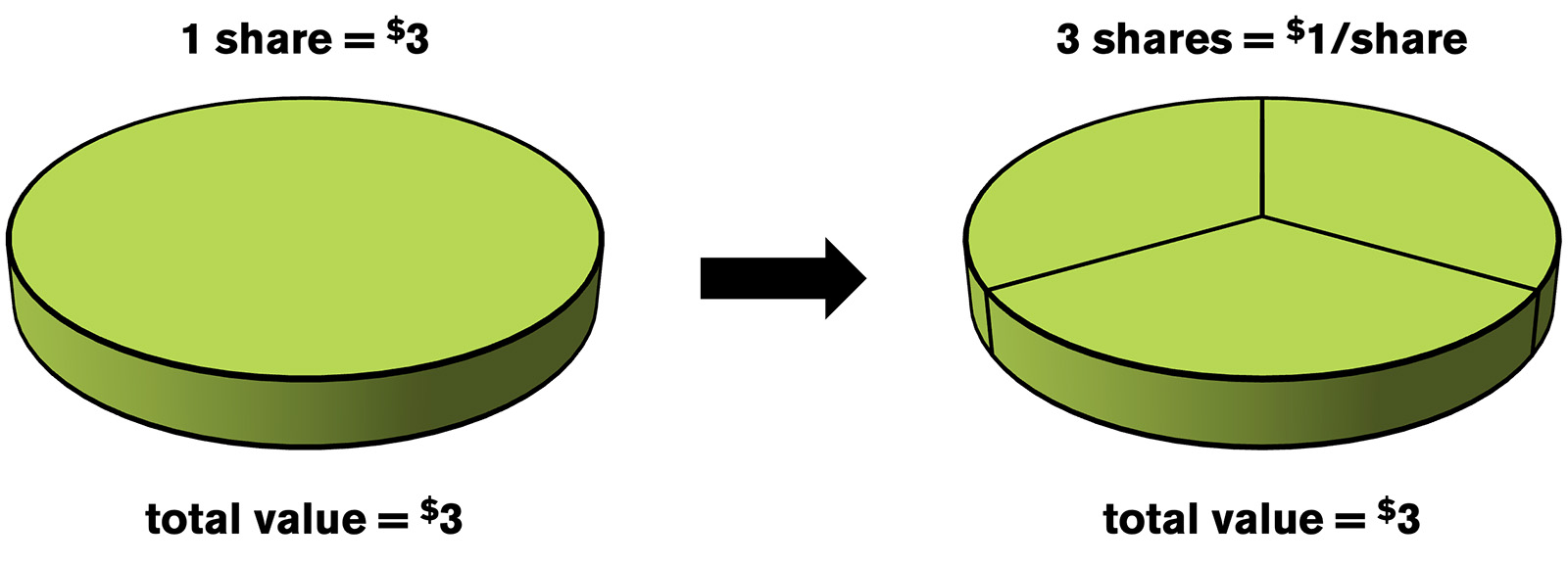

A stock split occurs when a company decides to increase the number of its shares by dividing each existing share into multiple new shares and reducing the share price by that multiple as well. This doesn’t change the total value of the shares that investors hold. The overall value of the company remains the same, but the price of each share is reduced.

For example if a company announces a 3-for-1 stock split, each existing share is split into three shares. If you owned 100 shares priced at $3 each before the split, you would own 300 shares priced at $1 each after the split. The total value of your shares would still be $3000.

The most common ratios for stocks to split are 2-to-1 and 3-to-1, however any ratio can be used. Recently Nvidia (NVDA) announced a 10-to1 stock split. Chipotle (CMG) announced a 50-to-1 split.

Why Do Companies Split Their Stock?

The goal of a stock split is to make the stock appear more affordable to a larger number of investors, including investors who might not be able to purchase whole shares at a higher price. This is less of an issue these days as platforms continue to expand partial share capabilities. M1 Finance is a great beginner investment platform that offers this feature.

A stock split is also seen as a positive indication from the company’s board of directors, showing confidence that the stock will continue to rise. This expectation of future growth can have a small positive influence on investor confidence, further increasing demand for the stock.

In both of these situations a more affordable stock price can in turn lead to a rise in demand and trading volume, which can improve liquidity. This should result in less slippage when actively trading. The same thing applies to derivatives on the stock, such as options.

What Are the Downsides of a Stock Split?

Stock splits don’t just happen at the whim of the board’s request. Behind the scenes there are lots of people involved in the regulatory oversight of the process. This means paying for legal and professional fees to get the stock split to actually comply with legal requirements.

Impact on Investors

For existing shareholders, the immediate effect of a stock split is the increase in the number of shares they own, with a corresponding decrease in the price per share. However, the total value of their investment remains unchanged. In the long run, if the company continues to perform well, the value of the increased number of shares can grow, leading to greater overall value.

What is a Reverse Stock Split?

A reverse stock split is the opposite of a stock split. In this case, a company decreases the number of its available shares by combining multiple shares into one. This results in an increase in the price per share without changing the total value of the shares that investors hold.

For example if a company announces a 1-for-5 reverse stock split, every five existing shares are combined into one share. If you owned 100 shares priced at $1 each before the reverse split, you would own 20 shares priced at $5 each after the split. The total value of your shares would still be $100.

Why Do Companies Perform Reverse Stock Splits?

Just like a normal split, reverse stock splits are all about perception. A higher share price can make the stock appear more respectable to investors. Some institutional investors and funds have mandates against investing in stocks priced below a certain level. Often reverse splits happen from sub $10 price points to get the stock trading closer to other more robust competitors in the industry.

A reverse split can also prevent a stock from becoming delisted. Stock exchanges, like the NYSE and the Nasdaq have minimum price requirements for listed companies. If a company’s share price falls below this threshold, it risks being delisted after 30 days. A reverse stock split can help boost the share price above the minimum requirement.

What Are the Downsides of a Reverse Stock Split?

This can be perceived either way, but reverse stock splits can reduce the total number of shareholders in the company. For example if there is going to be a 5-to-1 reverse split and a holder only has 4 shares, they will be “cashed out” from their position. We are ultimately talking about capital here, so there will be no “rounding up.” Investors will be paid the fair market value of the stock based on the closing print before the split is to take place.

Real-World Examples

Apple Inc. (AAPL): Apple has split its stock multiple times. For instance, in August 2020, Apple announced a 4-for-1 stock split. This was done to make the stock more accessible to a larger number of investors. Before the split, Apple’s shares were trading at around $500. After the split, the share price was adjusted to around $125, making it more affordable for retail investors.

The chart below has adjusted prices to the post split price. Before the pink dot at the bottom, shares would have reflected the $500+ price point.

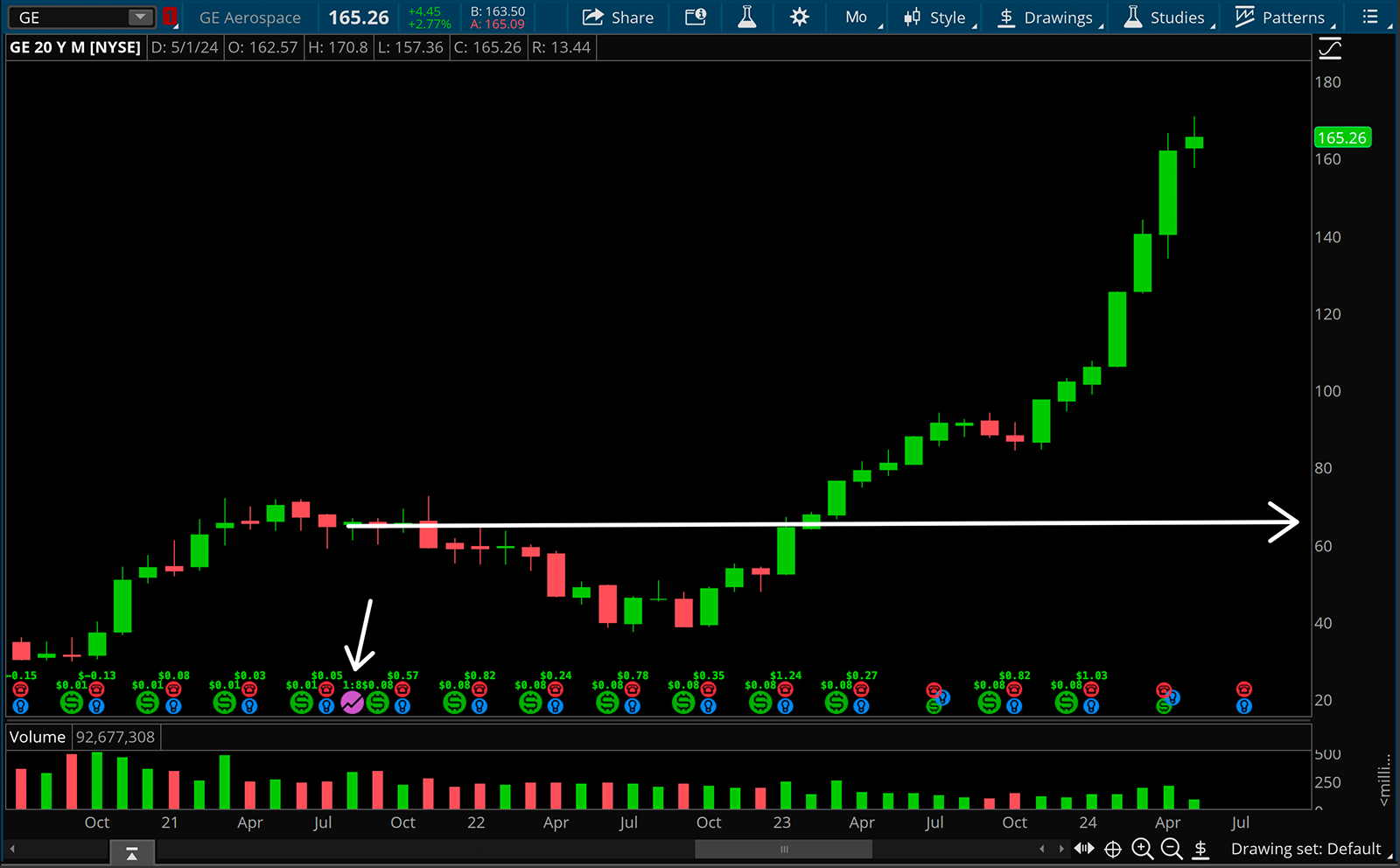

General Electric (GE): In 2021, General Electric announced a 1-for-8 reverse stock split. This was part of a larger restructuring plan to improve the company’s financial health. Before the reverse split, GE’s shares were trading at around $8. After the reverse split, the share price was adjusted to approximately $64.

In the image below, you can see that after the split, the company did end up seeing renewed interest and substantial upside improvement. Each candle below represents a months worth of price action.

Things to Consider

- No Direct Change in Value: Both stock splits and reverse stock splits do not directly change the total value of an investor’s holdings. The number of shares and the price per share are adjusted proportionately.

- Market Perception: These actions can influence how the market views a company. A stock split might be seen as a sign of confidence, while a reverse stock split could be interpreted as a move to address underlying issues.

- Long-Term Impact: The long-term effect on an investor’s portfolio depends on the company’s performance after the split or reverse split. A well-performing company will likely see its stock price rise regardless of the split.

- Tax Implications: Generally, stock splits and reverse stock splits are not taxable events. Unless you are “cashed out” of a reverse split your basis will be adjusted to the post stock split price.

Conclusion

Stock splits and reverse stock splits are board driven decisions made by companies to strategically manage their stock price and share structure. Splits do not change the total value of an investment, but they can have a significant impact on the market’s perception of the company. Your trading strategy should not be based on a stock split, but rather a solid understanding of technical analysis. Stock splits are something traders need to be aware of, but should not dictate how we trade the stock.