What is the Nasdaq 100?

The Nasdaq 100, often referred to as the NDX or as we call it the “NAZ”, is one of the largest stock market indexes tracking the performance of the top 100 non-financial companies listed on the Nasdaq Exchange. These companies are typically in the technology, consumer services, healthcare, and industrial sectors. The Nasdaq 100 is renowned for its emphasis on technology and innovation-driven firms, making it a highly regarded benchmark for the performance of growth driven industries in the United States.

Established by Nasdaq in 1985, the Nasdaq 100 has evolved into a leading indicator of the tech-heavy stock market segment. Here are the condensed requirements for a company to be listed on the Nasdaq exchange:

- Earnings: Positive pre-tax earnings in the past three years, with no single year of net loss.

- Capitalization with Cash Flow: Minimum $27.5 million in aggregate cash flow for the past three fiscal years, along with an average market capitalization of at least $550 million and revenues of $110 million in the previous fiscal year.

- Capitalization with Revenue: Companies can bypass the cash flow requirement if their average market capitalization is at least $850 million, and revenues in the prior fiscal year are at least $90 million.

- Assets with Equity: Companies can waive cash flow and revenue requirements and reduce market capitalization to $160 million if total assets are at least $80 million, and stockholders’ equity is at least $55 million.

Of the companies listed on the Nasdaq exchange, the top 100 companies by market cap size make up the Nasdaq 100 that meet the secondary criteria of:

- Listed exclusively on the Nasdaq, not cross listed

- Non financial in nature

- Have traded for at least three months on the exchange

- Minimum average daily trading volume of 200,000 shares

These requirements help ensure that the Nasdaq 100 represents a diverse and actively traded selection of prominent U.S. companies, particularly in the technology and innovation sectors.

How is the Nasdaq 100 Value Calculated?

The Nasdaq 100 is a capitalization-weighted index, meaning that each company’s weight in the index is determined by its market capitalization. Market capitalization is calculated by multiplying a company’s stock price by its outstanding shares. As a result, larger companies with higher market capitalizations have a more significant impact on the index’s performance.

The top 5 most heavily weighted stocks in the Nasdaq 100 as of September 2023 are:

- AAPL (Apple Inc) – 11.6%

- MSFT (Microsoft Corp) – 9.8%

- AMZN (Amazon.com Inc) – 5.1%

- NVDA (Nvidia Corp) – 4.2%

- META (Meta Platforms Inc) – 3.5%

Average Returns of the Nasdaq 100

Historically, the Nasdaq 100 has delivered average annual returns ranging from 16.4% to 18.7%. Therefore this average return acts as a benchmark for assessing the performance of technology-driven companies. While annual returns will certainly fluctuate, the Nasdaq 100 has demonstrated consistent positive gains over extended periods. In any 20-year rolling period tracking the index, negative returns have been exceedingly rare. Beating the Nasdaq 100’s performance for a year is considered outperformance, while persistent underperformance may mean its worth reassessing your trading or investment strategy. Why pick stocks and remain active if the passive index is generating larger returns?

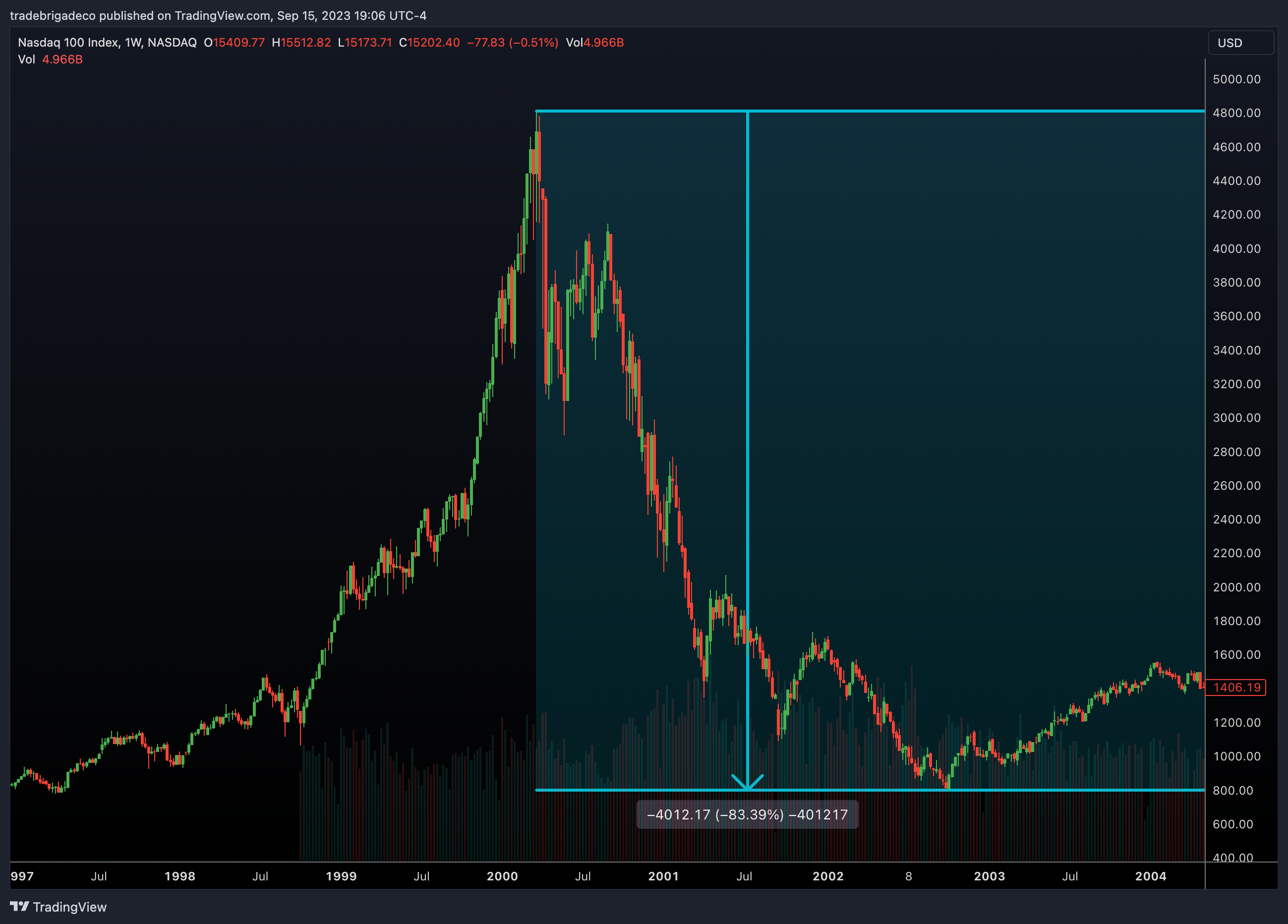

It’s important to note that the Nasdaq 100’s average return is not guaranteed, and the index’s performance can be influenced by market volatility and economic conditions. Extended periods of negative returns are infrequent but have a look at the drawdown as the dot com bubble came to a grinding halt. More than 75% of the index’s value was wiped out over a two year period. The more attractive returns compared to the S&P500 certainly come at the cost of volatility.

How Do You Invest in the Nasdaq 100?

Investing in the Nasdaq 100 can be achieved by buying shares of an index fund or exchange-traded fund (ETF) that replicates the index’s performance. When investing, it’s important that you consider the expense ratio of the fund. Common examples of funds that track the Nasdaq 100 include:

- QQQ (Invesco QQQ Trust)

- ONEQ (Fidelity Nasdaq Composite Index Tracking Stock)

- VIGRX (Vanguard Index Trust Growth Index Fund)

How Can You Trade the Nasdaq 100?

Trading the Nasdaq 100 differs from long-term investing because it typically involves a shorter time horizon. Traders focus on factors like liquidity to execute swift buy and sell orders with minimal slippage. Most traders consider various instruments for trading the Nasdaq 100, including shares, options, or futures contracts linked to the index. The /NQ futures are the futures product, and the QQQ offers the best options market liquidity for traders seeking leverage. Before starting to trade the S&P or any product for that matter, you should have a solid understanding of technical analysis.

Conclusion

The Nasdaq 100 is a prominent stock market index made up of 100 non-financial companies, primarily in the technology and innovation sectors. It serves as a key indicator of the performance of these dynamic industries within the U.S. stock market. Understanding the Nasdaq 100 provides valuable insight into the broader market landscape and emerging trends in technology and innovation.