Trading The 3 Bar Play Strategy

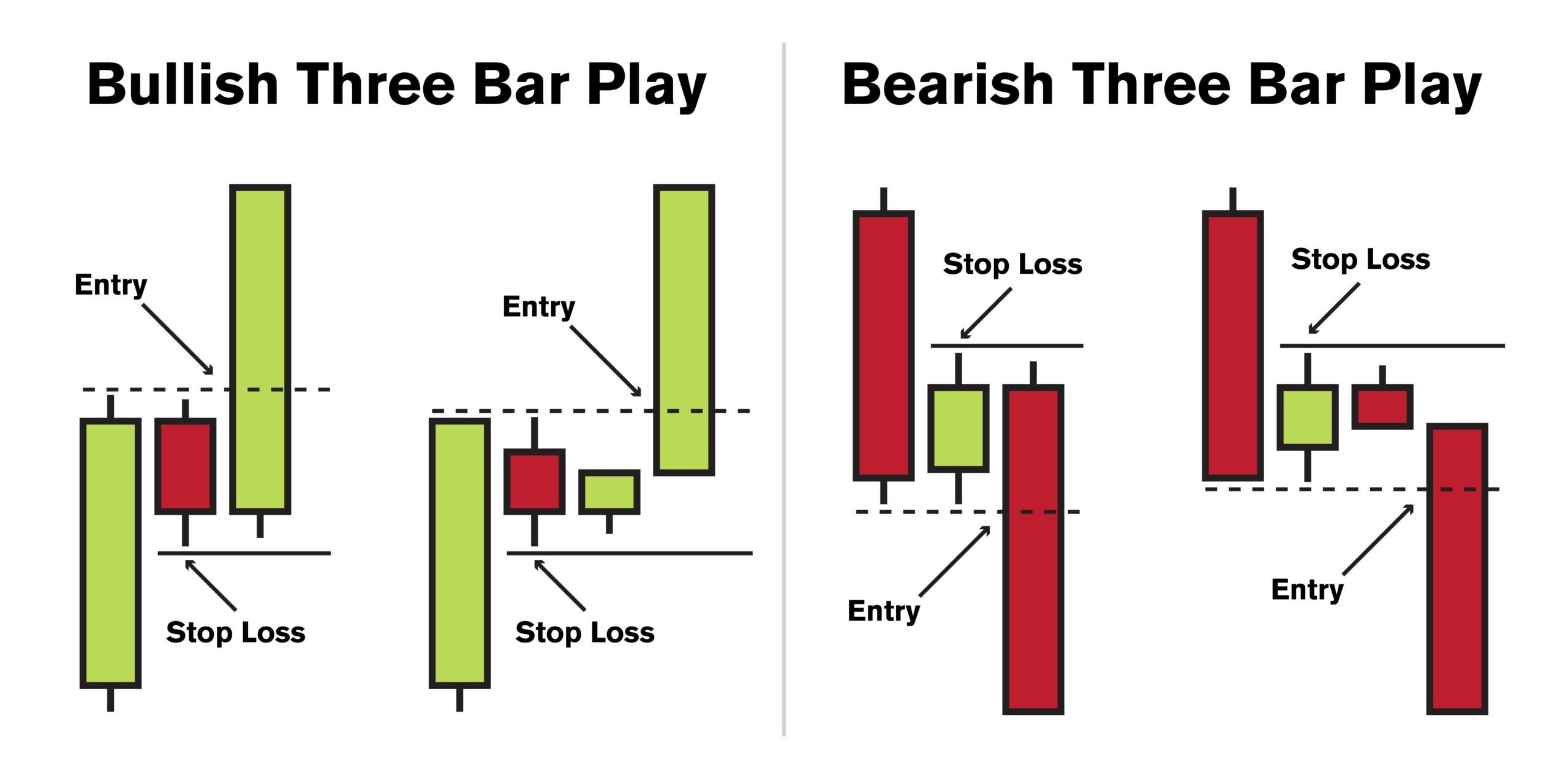

The Three Bar Play is a trading strategy using purely candlestick analysis, aimed at taking advantage of recent momentum in either direction, up or down. The Three Bar Play is a sequence of three consecutive bars: a momentum candle followed by an inside bar (or two) and triggering on a break of the inside bar high or low in the direction of the first momentum bar. The inside bars should be in the upper 50% of the range of the first momentum candle. The stop loss is often placed under or above the opposite extreme of the inside bar depending on trade direction. This strategy enables traders to capitalize on market momentum with tight risk.

Decoding the Components of the Three Bar Play

- The Momentum Candle (Bar 1): The strategy begins with a momentum candle, often characterized by a large range and perhaps even a break of a key level. This candle provides a strong indication of market sentiment and the potential direction of the trend. We call these trending bars, but you may also hear them referred to as marubozu candles.

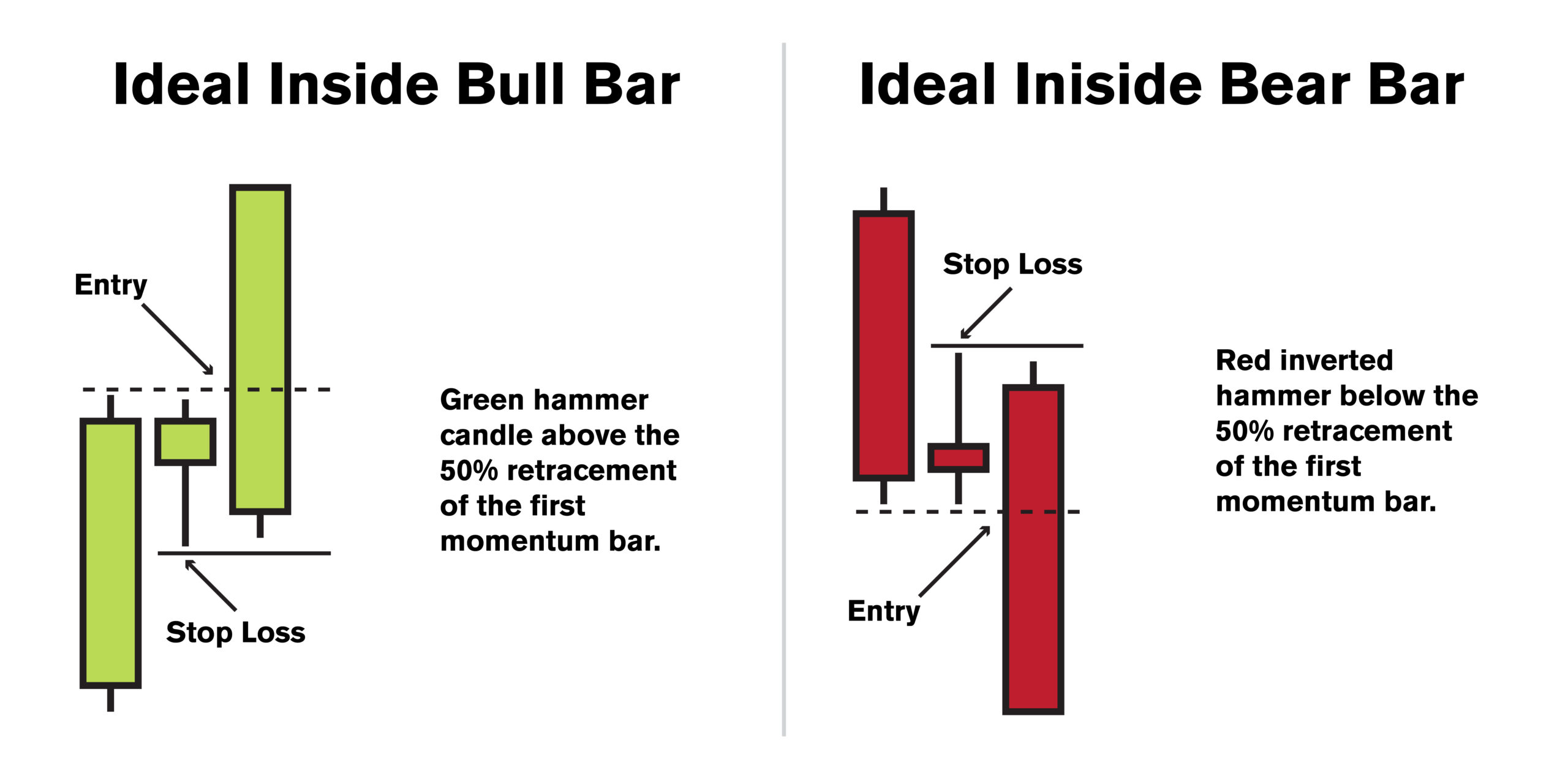

- Inside Bar (Bar 2): Following the momentum candle, the second bar is an inside bar that forms within the range of the momentum candle.The inside bar should be situated in the upper 50% of the range of the momentum candle for bullish Three Bar Plays. In bearish Three Bar Plays, the inside bar wants to be contained in the lower 50% of the range. This indicates a potential consolidation phase where traders are assessing the recent price movement. We often look for dojis, but the pattern is even stronger for bullish outcomes if its an inside hammer, and even stronger for bearish outcomes if its an inside inverted hammer. Inside bars are often annotated as (i).

- You may get a second inside bar in the sequence, in which case technically we have a Four Bar Play, but most traders will still refer to it as a Three Bar Play structure. Ideally this second inside bar is inside of the first inside bar classifying it as a double inside bar often annotated as (ii).

- Continuation Bar (Bar 3): For the pattern to complete traders must wait for a breakout from the range formed by the inside bar(s). The entry point is typically triggered by a move beyond the high or low of the inside bars. This breakout signifies that the temporary consolidation phase is concluding and continuation of the original momentum is underway.

Benefits and Considerations

The Three Bar Play strategy’s primary advantage is that you have defined risk going into the trade. The stop loss is always going to go on the opposite side of the inside bar from which the breakout took place. Doing so keeps risk tight and logical, preventing you from being involved in a reversal.

The odds of the trade working out also increase when you can execute the trade from this pattern near a key level of support or resistance that you have identified on a higher timeframe. A comprehensive understanding of technical analysis, will ensure you are seeing the charts properly and increase the odds of the trade working in your favor. Aside from having a key level nearby, you’ll also do better if trading in the direction of the higher timeframe trend.

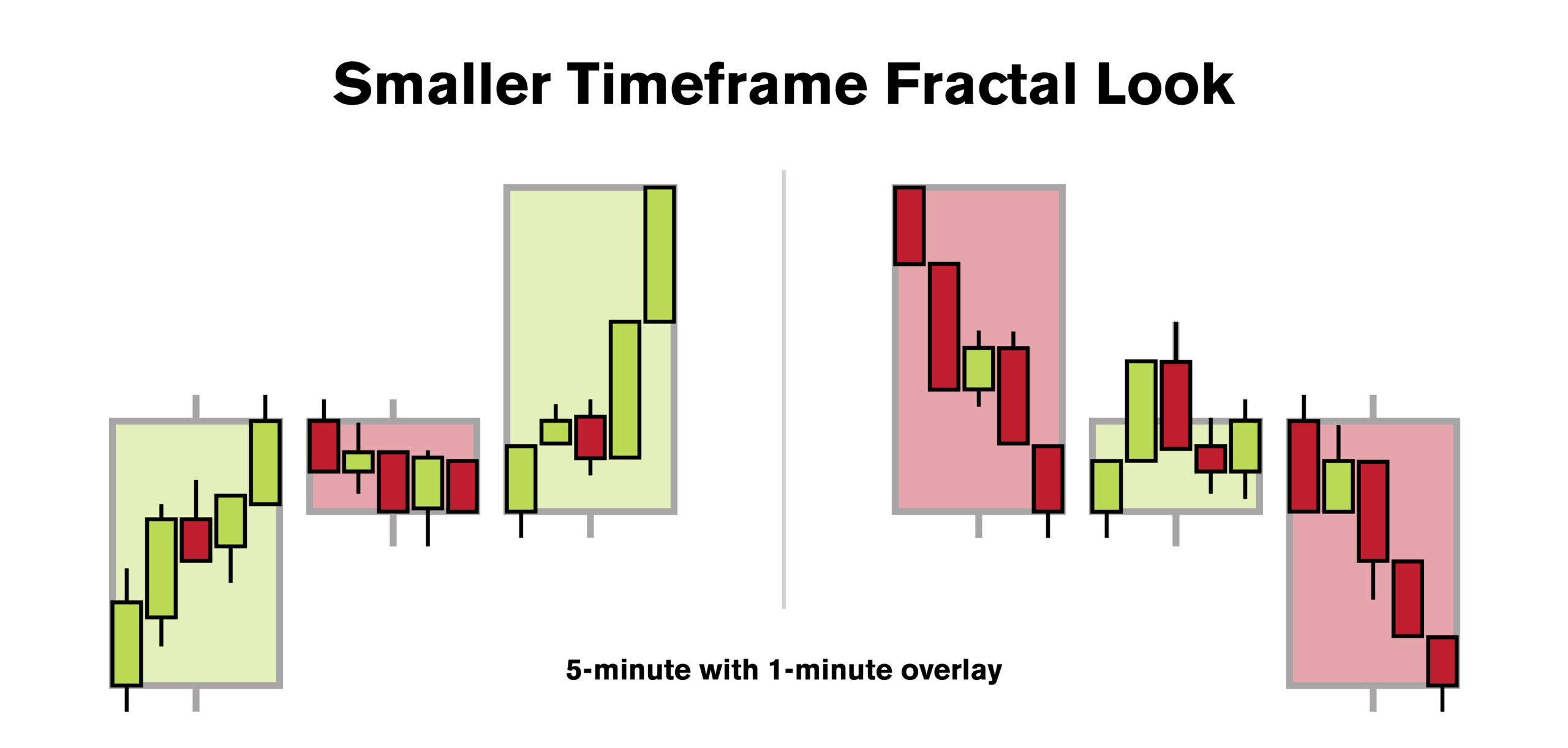

The Three Bar Play strategy can be applied to various timeframes and trading instruments. Remember that trading is fractal and we can go up and down the timeframes to make more sense of this pattern. For example a 1-hour Three Bar Play (three 1-hour candles make the pattern) is likely just a 5 minute bull flag formation. A daily Three Bar Play (three daily bars make the pattern) is likely just a 1-hour bull flag formation.